Stablecoin public chains: In the name of institutions and privacy, they actually promote distribution and revenue

Software is reshaping the world, and stablecoins are now transforming blockchain itself.

This time, it’s not about Coinbase’s Base or Robinhood’s L2—Circle and Stripe have both elected to build proprietary stablecoin Layer 1 networks, effectively breaking away from the restrictions of established public blockchains and completely reconstructing core mechanisms and gas tokens around stablecoins.

The banks have lost their edge, and stablecoin providers are now in a race for dominance.

While Circle’s Arc and Stripe’s Tempo may seem to compete directly with Tron and Ethereum, their real target is the post-central-bank global clearing structure. The existing fiat currency infrastructure—Visa and SWIFT—can no longer meet the worldwide liquidity demands fueled by stablecoins.

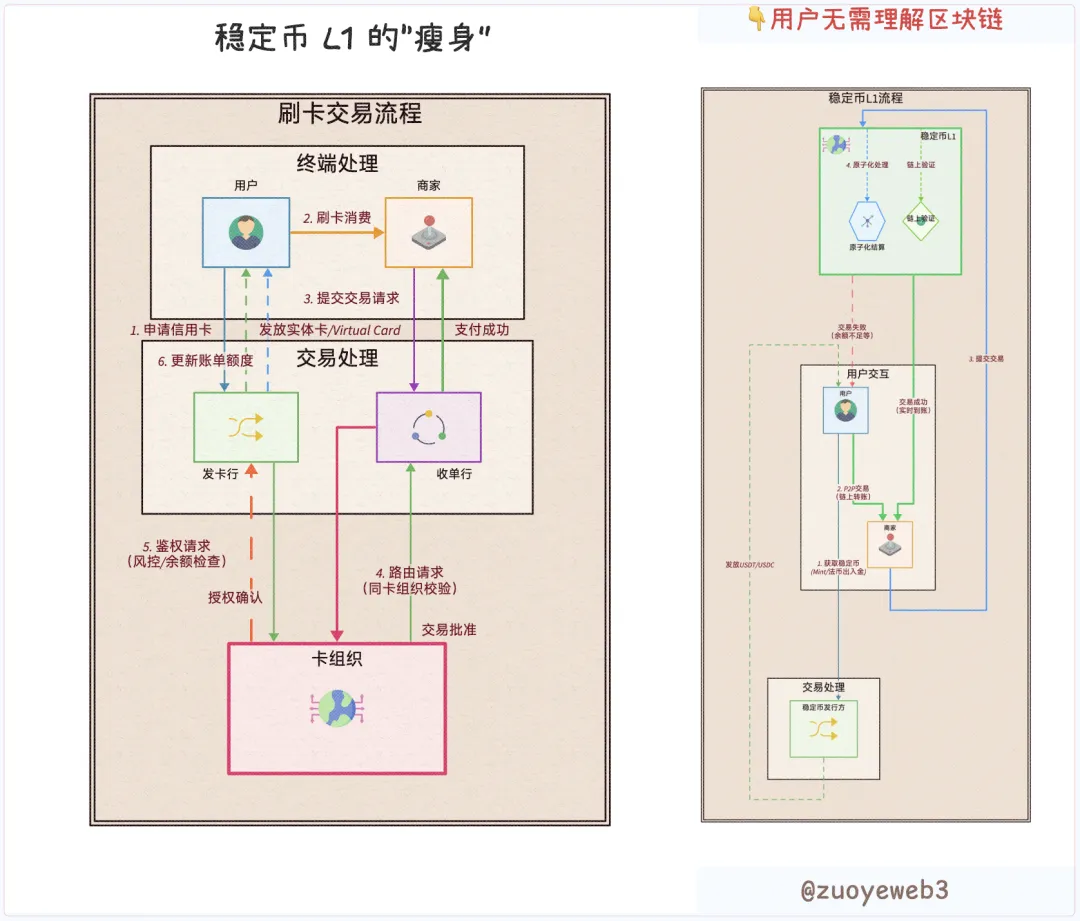

Cross-Industry Disruption: Card Networks Yield to Stablecoin Public Chains

For nearly three decades, the Wintel alliance dominated the personal computer market, until ARM’s ascent in mobile finally pushed Intel into decline—even without any strategic blunders.

Card networks and bank cards didn’t evolve in tandem. In 1950, the first card network—Diners Club—built a credit accounting system tailored for restaurants and loyal customers. This laid the foundation for credit and rewards programs. Only in the 1960s did card networks integrate with banking, enabling U.S. community banks to transcend state and national lines through credit cards and ultimately achieve global reach.

Unlike banks, which routinely shift with the Federal Reserve’s monetary cycles, card networks like Visa and MasterCard operate resilient, high-margin cash flow businesses. For instance, in 2024, Capital One acquired Discover for $35.3 billion, becoming a behemoth that operates as both card issuer and network.

This full integration in traditional banking foreshadowed stablecoin issuers launching their custom public blockchains. True control of issuance, distribution, and redemption channels requires end-to-end integration.

Since the Genius Act, the dollar’s circulation model has fundamentally shifted. While commercial banks still enable credit creation and monetary issuance (M0/M1/M2), Tether and Circle’s US Treasury holdings now surpass those of several sovereign states.

Stablecoins are now plugged directly into government bond markets. Although banks can still issue stablecoins for self-preservation, card networks and cross-border payment providers face a true survival challenge.

- • Banking —> Stablecoin Issuers (USDT, USDC)

- • Card Networks/SWIFT/PSP —> Stablecoin Layer 1

In traditional payments, users, merchants, issuers, acquirers, and card networks each played distinct roles. With blockchain’s programmability, any actor can be reduced to a “user.” Whether it’s institutional privacy vaults or consumer convenience, it’s all differentiated by code logic.

Stablecoin Layer 1 platforms eliminate the need for any intermediary institution. With just users, stablecoins, and the L1, any function—including regulatory compliance—can be swapped or stacked directly.

Image Description: How transaction flows are being reimagined

Image Source: @zuoyeweb3

That’s not to say specialized issuers and technology providers will vanish. From a modular code perspective, service providers can be freely audited and selected. Take virtual cards: most profits accrue to upstream providers, while issuers like U Card typically operate at a loss to build market share.

Technological innovation always precedes changes in organizational structure.

If you could build a new Visa today from scratch, you could keep all profit flows and distribute value directly to users.

Before the Discover acquisition, Capital One paid Visa or MasterCard a 1.5% fee, just as USDT or USDC must pay gas fees to Tron or Ethereum.

Today, as Circle promotes Arc, Coinbase Commerce has integrated with Shopify, and Circle has partnered with Binance to support its yield-bearing stablecoin USYC.

Tether claims to generate 40% of on-chain fees. Circle even pays Coinbase an extra $300 million per quarter in “subsidies,” highlighting the business logic of cutting out middlemen to build proprietary distribution and terminal networks.

Circle has chosen to architect its network in-house, while Tether favors external partners like Plasma and Stable for its expansion race.

Stripe stands out. While lacking its own stablecoin, Stripe controls the user network. After acquiring Bridge and Privy, Stripe has achieved end-to-end technical integration. It’s only a matter of time before Stripe issues or backs a stablecoin of its own.

The bottom line: stablecoin issuers, distribution channels, and user networks are all moving to build closed ecosystems:

- • Issuers: Circle’s Arc, Tether’s Plasma and Stable, USDe’s Converge

- • Distribution Channels: Exchanges like Coinbase and Binance, plus existing public chains such as Ethereum and Tron

- • User Networks: Stripe’s proprietary Tempo

French liberty isn’t British liberty; USDT’s L1 isn’t a haven for USDC. As blockchain and card network rivals multiply rapidly, the age of compromise is ending—and the competitive surge is unstoppable.

Technology Diffusion: Building Public Chains Is Easy—Winning Institutions Is Hard

Defending freedom to extremes isn’t evil; quietly pursuing justice isn’t necessarily a virtue.

Privacy concerns have faded for mainstream users. As the QUBIC-Monero saga shows, institutional treasury management now gets the spotlight. Private transactions are a paid privilege for institutions; for ordinary users, transaction fees are what matter.

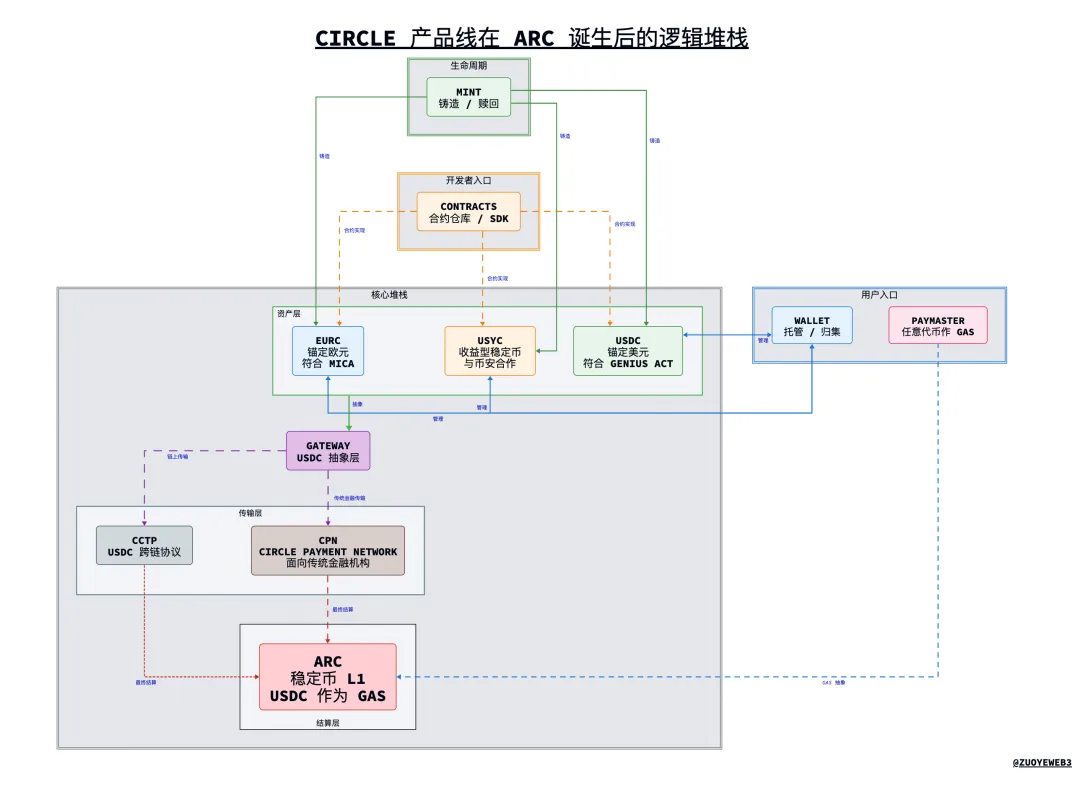

Prior to Arc, Circle’s sprawling product suite bordered on unwieldy. Arc’s unified framework unlocks new synergy, giving USDC the chance to step out from Coinbase’s shadow.

Image Description: Circle’s product architecture after Arc

Image Source: @zuoyeweb3

Arc offers a window into the technical blueprints for future stablecoin L1s. The following breakdown reflects the author’s understanding only (see universal-level disclaimer).

1. Product Overview

- • USDC/EURC/USYC: Circle’s three core stablecoins. USDC is pegged to the dollar and adheres to the Genius Act; EURC is pegged to the euro and observes MiCA regulations; USYC is a yield-bearing stablecoin in partnership with Binance.

- • CPN (Circle Payment Network): Circle’s USDC-based cross-border settlement network (think SWIFT for stablecoins)

- • Mint: Platform for minting Circle’s stablecoins

- • Circle Wallet: Hub for retail and institutional users to manage all Circle stablecoins

- • Contracts: Circle’s smart contracts for stablecoins like USDC

- • CCTP: Technical standard for USDC cross-chain interoperability

- • Gateway: Abstracted access layer for USDC—users interact without worrying about underlying technical details

- • Paymaster: Enables use of any token to pay gas fees

- • Arc: Circle’s stablecoin Layer 1, with USDC as its native gas token

2. Technical Stack

- • Main stack: USDC/EURC/USYC —> Gateway —> CCTP (on-chain)/CPN (trad-fi)—> Arc

- • Supporting modules: Mint (deposit onboarding), Wallet (asset aggregation), Contracts (programmability), Paymaster (universal gas support)

Arc employs a DPoS-based PoS mechanism with up to 20 nodes, aiming for 3,000 TPS and sub-second transaction finality, while offering gas fees that can drop below $1. Arc supports privacy transfers and institutional vaults, enabling large-scale enterprise asset on-chain management—likely a key motivation for Circle to build its own L1. Beyond stablecoin transfers, enterprise asset management is emerging as a major competitive arena.

The core L1 architecture is future-proofed for assets like RWAs. The Malachite consensus upgrade—adapted from Informal Systems’ CometBFT post-acquisition—purportedly allows up to 50,000 TPS.

The stack delivers EVM compatibility, MEV protection, forex (FX) engines, and trading optimization. With Cosmos infrastructure beneath, launching projects at Hyperliquid scale is technologically straightforward. Deploying as an L2 is as easy as spinning up a Docker instance.

Arc’s roadmap includes TEE/ZK/FHE/MPC cryptography integration. Public chain launch costs are rapidly approaching commodity levels, but building robust ecosystems—distribution and endpoints—remains a massive challenge. Visa took 50 years, USDT/Tron took 8, and it’s now 11 years since Tether first minted USDT.

Time is the greatest adversary of stablecoin L1s, prompting a split between practical action and market messaging:

- • Action: Retail adoption —> Channel expansion —> Institutional onboarding

- • Narrative: Institutional compliance —> Mass adoption

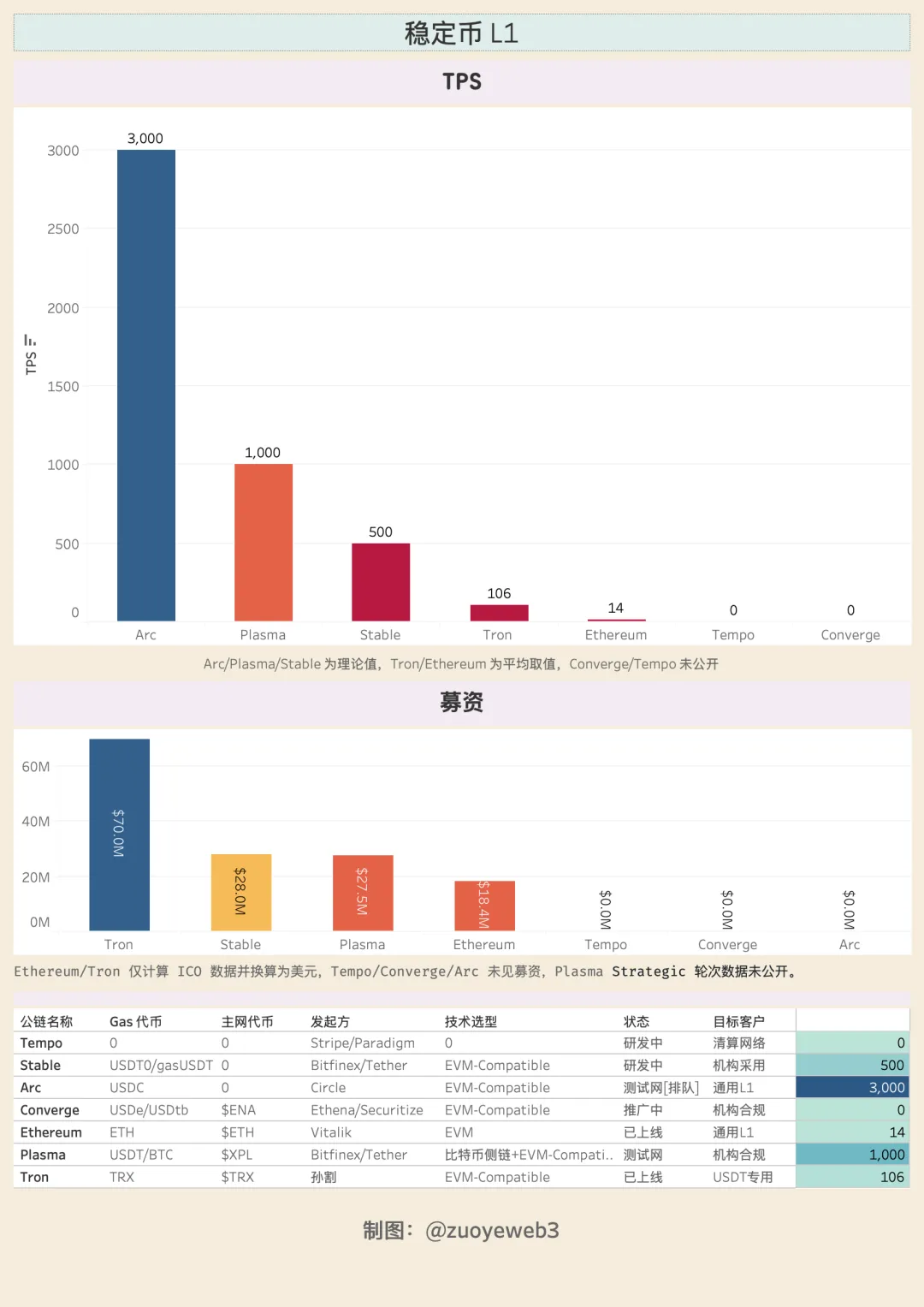

Tempo and Converge target institutional onboarding; Arc leads the charge on global compliance. Compliance plus institutions is the stablecoin L1 go-to-market playbook, but that’s just the surface. Each is leveraging crypto-native techniques for growth.

Plasma and Converge are both teaming with Pendle. Circle is quietly promoting yield stablecoins (USYC) and 24/7 USDC swaps. Tempo, led by Paradigm co-founder Matt Huang, is committed to being blockchain-first—not just another fintech platform.

Institutional onboarding is about compliance. Meta pledges privacy, but in practice, user adoption always precedes institutional buy-in. Remember, USDT’s earliest and largest base was ordinary users in Asia, Africa, and Latin America—now it’s a fixture in institutional portfolios, too.

Institutions don’t excel at distribution; grassroots outreach is the internet’s powerhouse.

Image Description: Stablecoin Layer 1s: Comparative Overview

Image Source: @zuoyeweb3

Emerging stablecoin Layer 1s are either heavily funded or backed by institutional giants. Under the Genius Act and MiCA, they generally can’t offer interest payments as an incentive. Yet USDe achieved $10 billion in issuance in just a month by leveraging recursive lending.

The gap between on-chain yield distribution and front-end user onboarding creates fertile ground for yield-bearing stablecoins. USDe handles on-chain issuance, while USDtb became a Genius Act-compliant stablecoin through Anchorage’s custody.

Yield is a powerful magnet for user growth—a compelling lure that invites innovation outside regulatory boundaries.

Conclusion

Before stablecoin Layer 1s, TRC-20 USDT was the de facto global clearing network for USDT, with genuine user adoption—so Tether had no incentive to share profits with exchanges. USDC simply played the compliant counterpart, just as Coinbase is Binance’s public-market mirror.

Stablecoin Layer 1s are now challenging Visa and Ethereum. The world’s monetary plumbing is being reconstructed from the ground up. As dollar dominance declines, stablecoin Layer 1s are targeting FX. The market is always right—stablecoins are eager to expand their footprint.

It’s invigorating to see innovation in public chains more than a decade after the birth of blockchain. Perhaps the greatest reassurance is that Web3 isn’t just Fintech 2.0—DeFi is reshaping CeFi and TradFi, and stablecoins are redefining banking (deposits and cross-border payments).

Let’s hope stablecoin Layer 1s remain true to blockchain’s foundational ideals.

Disclaimer:

- This article is republished from [Zuoye Crooked Tree]; copyright resides with the original author [Zuoye Crooked Tree]. For republishing concerns, please reach out to the Gate Learn team for timely handling according to established procedures.

- Disclaimer: The opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are provided by the Gate Learn team. Do not copy, distribute, or plagiarize translated content without crediting Gate where not otherwise specified.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

What Is USDT0