Prévision des prix d'Ethereum (ETH) : tendances des prix et facteurs influents

Analyse des facteurs clés affectant le prix de l'ETH

1. Le changement dans l'utilisation des fonds par la Fondation Ethereum

Traditionnellement, la Fondation Ethereum (EF) a été une source potentielle de pression à la vente sur laquelle le marché s'est concentré, surtout lorsque le prix de l'ETH approche de la plage supérieure, car sa liquidation déclenche souvent une réaction en chaîne sur le marché. Cependant, les dernières actions de mai 2025 montrent des signes de transformation.

EF a emprunté l'équivalent de 2 millions de dollars de stablecoins GHO auprès du protocole de prêt décentralisé Aave, utilisant de l'ETH enveloppé (WETH) comme garantie, obtenant des fonds sans vendre d'ETH. Cette stratégie est considérée comme EF commençant à utiliser des outils DeFi pour des opérations de levier, conservant des actifs tout en finançant de manière flexible le développement de projets, démontrant une croyance à long terme dans Ethereum lui-même et dans les applications financières innovantes.

Marc Zeller, le fondateur de l'Initiative Aave Chan (ACI), a déclaré qu'Aave est conçu pour les croyants. Il a souligné que de telles opérations par l'EF appartiennent à une stratégie de boucle, qui est la logique de réutilisation des fonds provenant des emprunts garantis et de la réinvestissement, largement utilisée dans l'espace DeFi pour amplifier les profits et la liquidité.

(Remarque : GHO est un stablecoin décentralisé émis par Aave)

2. La peur du marché d'une vente d'ETH s'est apaisée.

Selon les données on-chain, EF a vendu environ 130 000 à 160 000 ETH au cours des dernières années, et à la fin de 2024, il détient environ 240 000 ETH. Avec ce changement de stratégie de financement, les préoccupations de la communauté concernant les ventes continues d'EF ont commencé à diminuer. Notamment, dès février de cette année, EF avait déployé 45 000 ETH dans des protocoles de prêt DeFi majeurs, notamment Aave, Compound et Spark, Aave recevant plus de 30 000 ETH en liquidité. Ces actions non seulement stabilisent l'écosystème, mais allègent également indirectement la pression de vente potentielle sur le marché.

3. Signaux pour les institutions et l'entrée de nouveaux capitaux

En plus des actions de l'EF, une autre force motrice derrière la hausse des prix de l'ETH provient des afflux de capitaux institutionnels :

- Sharplink Gaming (cotée sur le NASDAQ) a annoncé qu'elle investira 425 millions de dollars pour établir un fonds ETH et explorer l'intégration des jeux blockchain et des applications de divertissement.

- La plateforme de trading au comptant d'ETH a connu des entrées de fonds pendant huit jours consécutifs, reflétant que des fonds se repositionnent, considérant l'ETH comme la prochaine fenêtre d'opportunité.

Ces tendances indiquent que le marché ne considère plus ETH simplement comme un jeton de protocole technique, mais comme un actif central du système financier crypto, et il pourrait même évoluer en un actif souverain de Web3.

Analyse technique de l'ETH et prévisions

Tendance à court et moyen terme (1 - 3 mois)

- Zone de support clé : 2 200 $ ~ 2 400 $

- Franchir la zone de résistance : 2 800 $ ~ 3 000 $

Si les fonds et le récit continuent, avec une stabilisation du marché du Bitcoin, l'ETH devrait tester à nouveau le chiffre rond de 3 000 $, ce qui pourrait déclencher davantage d'arbitrage et de fonds à effet de levier.

Prévisions à long terme (deuxième moitié de 2025 à 2026)

À mesure que l'écosystème Layer 2 mûrit et que Danksharding et EIP-4844 sont mis en œuvre, ETH atteindra de nouveaux jalons en matière de scalabilité et de coûts de transaction, offrant une base plus solide pour des applications telles que DeFi, le jeu, l'IA et RWA.

- Plage de prévision optimiste : 4 500 $ ~ 6 000 $

- Plage de prédiction conservatrice : 3 200 $ ~ 4 000 $

Facteurs de risque : Incertitude de la réglementation américaine, retards dans les progrès technologiques, pression de la concurrence des Layer 2

Le récit DeFi de l'ETH monte à nouveau.

Grâce aux opérations à effet de levier de cet EF, il ne se contente pas de rompre avec la convention passée de collecte de fonds par la vente de pièces, mais recentre également le marché sur le potentiel d'intégration d'Ethereum et des protocoles DeFi. Si des protocoles établis comme Aave et Compound peuvent répondre à la demande des utilisateurs institutionnels et des actifs de niveau national, cela entraînera la réévaluation de l'ETH.

De plus, la logique de l'utilisation des actifs sans les vendre offre un autre module pour la gestion des capitaux et une liquidité stable pour l'ensemble du marché. Ce changement n'est pas simplement un ajustement mineur dans la stratégie d'EF, mais une transformation significative de la logique financière de l'écosystème Ethereum vers un cycle de levée d'actifs.

Prévision du prix de l'ETH

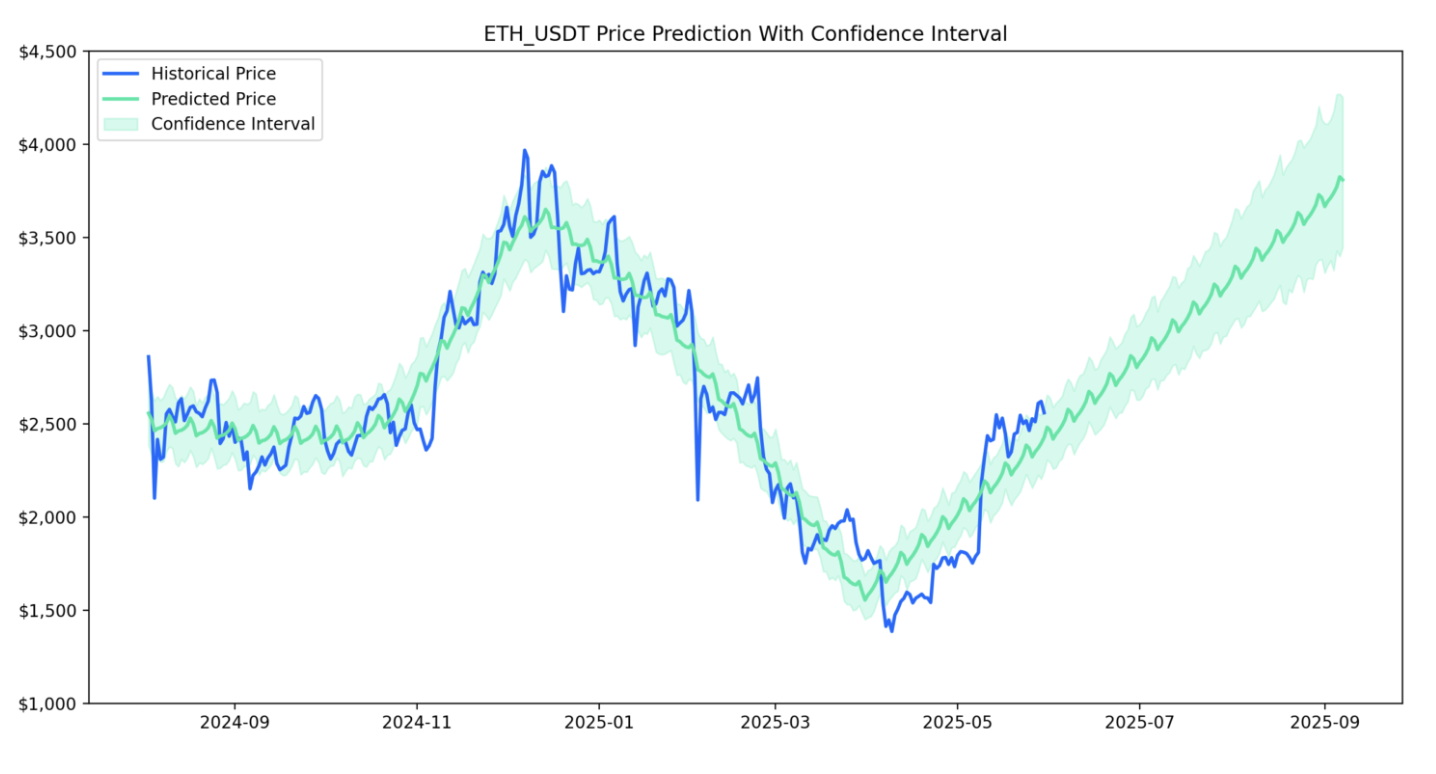

Grâce aux calculs de données des modèles d'IA, en se référant aux prix passés de l'ETH et aux informations connexes, les prévisions des prix futurs sont faites uniquement à des fins de partage de données et non comme conseils d'investissement. Veuillez vous référer au graphique ci-dessous :

Tendance de prévision du prix de l'ETH

Prévision du prix de l'ETH et intervalle de confiance

Commencez à trader des ETH au comptant immédiatement :https://www.gate.com/trade/ETH_USDT

Résumé

La performance des prix de l'Ethereum est le résultat global du sentiment de marché et des flux de capitaux. Le comportement de l'EF abandonnant les ventes massives et adoptant la DeFi n'est pas simplement un ajustement d'allocation d'actifs, mais cela pourrait être une étape clé pour favoriser la maturité de l'ensemble du modèle financier Web3. Avec le développement des Layer 2 et des blockchains modulaires, le positionnement de l'ETH en tant que couche de confiance et couche de règlement deviendra plus solide. Le prix peut fluctuer à l'avenir, mais son récit irremplaçable est progressivement renforcé.