xStocks and the New Wave of US Stock Tokenization: The Rise, Challenges, and Prospects of On-Chain Securities

Overview of US Stock Tokenization and Global Status

US stock tokenization refers to the process of converting traditional US stock assets into digital tokens using blockchain technology. These tokens are typically pegged to real stocks at a 1:1 ratio and support trading and settlement on the blockchain. Unlike traditional stocks that can only be traded during specified trading hours, tokenized US stocks can be traded 24/7 and support fractional ownership, significantly lowering investment barriers and improving liquidity. According to forecasts by institutions such as the Boston Consulting Group, the global tokenization scale of real-world assets (RWA) may reach $2 trillion to $30 trillion by 2030, with stocks and ETFs accounting for a major share. By 2025, although the overall scale of tokenized assets is still at the level of tens of billions of dollars, US stock tokenization, as a core component, has enormous potential.

Attempts at US stock tokenization can be traced back to the Security Token Offering (STO) wave in 2017, but early projects mostly remained at the conceptual and experimental stages. Around 2020, centralized exchanges like FTX and Binance launched “tokenized stock” services (essentially internal ledger certificates), offering trading on hot stocks like TSLA (Tesla) and AAPL (Apple), but these services were quickly terminated due to lack of on-chain transparency and regulatory pressure. The DeFi sector also saw synthetic asset solutions: Mirror Protocol in the Terra ecosystem launched synthetic tokens (mAssets) pegged to US stock prices, and the Synthetix protocol supported synthetic stocks (like sTSLA, sAAPL) based on SNX collateral. However, these purely synthetic tokens were not backed by real assets, and Mirror eventually collapsed to zero value due to the UST crash, while Synthetix gradually delisted synthetic stock products due to lack of demand. Therefore, it wasn’t until recently that on-chain stock tokens issued by European or Swiss compliant institutions and 1:1 backed by physical stocks (such as Backed Finance’s xStocks and Dinari’s dShares) began to gain market attention and promotion.

xStocks Platform Overview

Source: https://xstocks.com/

Backed Finance’s xStocks series issues stock tokens backed by physical assets through Ethereum (ERC-20) and Solana (SPL) chains, bridging traditional finance with on-chain trading. In May 2025, Swiss compliant asset tokenization platform Backed Finance first launched the xStocks product line, including over 60 1:1 pegged tokens for US stocks and ETFs such as Apple (AAPL), Tesla (TSLA), NVIDIA (NVDA), and S&P 500 Index ETF (SPY). The underlying physical stocks of xStocks are held by regulated custodial institutions (such as Swiss banks like InCore Bank and Maerki Baumann), with the issuer being an SPV holding EU regulatory approved ISIN numbers, ensuring asset security and transparency from a legal perspective. In compliance with regulations, xStocks is only open to non-US users, with US investors prohibited from purchasing or holding the product. These tokens support buying, selling, lending, and market making on global crypto exchanges such as Bybit and Kraken, as well as DeFi protocols (such as Raydium, Jupiter, Kamino on Solana), truly achieving cross-platform circulation and composable trading.

The core features of xStocks include:

- 24/7 Trading: Users can trade xStocks anytime on centralized or decentralized platforms, breaking the limitations of traditional stock market trading hours.

- Fractional Ownership: The tokenization mechanism lowers the entry barrier for high-priced stocks (e.g., purchasing small shares with USDC/USDT), allowing more investors to participate.

- Global Coverage: Users can transfer token liquidity between different ecosystems, achieving global trading through on-chain liquidity and open markets.

Users can trade xStocks anytime on centralized or decentralized platforms, breaking the limitations of traditional stock market trading hours. The tokenization mechanism lowers the entry barrier for high-priced stocks (e.g., purchasing small shares with USDC/USDT), while leveraging on-chain liquidity and open markets, users can transfer token liquidity between different ecosystems. xStocks also integrates Chainlink oracles and CCIP protocol to ensure the accuracy of on-chain price data and cross-chain interoperability. Overall, the xStocks platform combines the value support of traditional stocks with the efficient trading advantages of blockchain, allowing global investors to participate in US stock investments using crypto wallets and DeFi tools within a secure custody and regulatory framework.

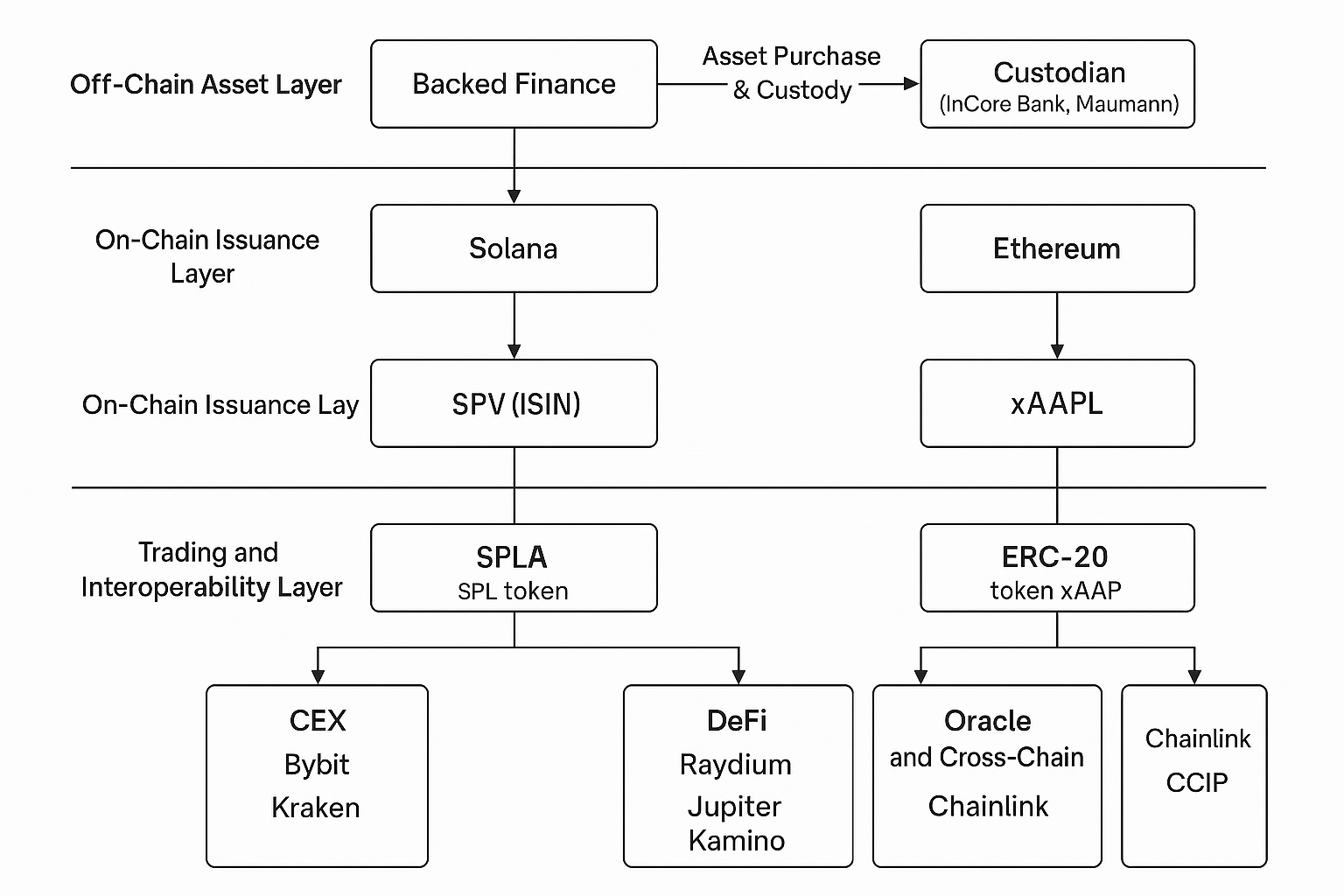

Detailed Technical Architecture of xStocks

The technical architecture of xStocks revolves around two core principles: “off-chain compliance + on-chain composability,” ensuring legal custody of physical assets and free circulation of on-chain tokens. The overall system design can be divided into three levels: Off-chain Asset Layer, On-chain Issuance Layer, and Trading Interoperability Layer, which collaboratively build a compliant, secure, and flexible tokenized stock system.

xStocks Technical Architecture Diagram (Source: Gate Learn Creator Max)

1. Off-chain Asset Layer: Physical Stock Custody + SPV Structure

The assets behind xStocks are issued and managed by Switzerland-based Backed Finance, operating as follows:

- Asset Purchase and Custody: When users purchase an xStocks token (e.g., xTSLA) through on-chain protocols or platforms, Backed Finance correspondingly purchases an equal amount of real stocks in the traditional stock market and deposits them in trust accounts under regulated banks (such as InCore Bank, Maerki Baumann).

- SPV Legal Structure: Each token issuance is registered through a dedicated Special Purpose Vehicle (SPV) and applies for an EU ISIN identification code. This structure ensures that each class of stock token has a unique legal issuance vehicle and is 1:1 pegged to the corresponding asset.

- Off-chain Audit and Compliance Information Disclosure: The quantity, type, and status of custodial assets are regularly disclosed by third-party audit institutions, ensuring that on-chain tokens are always fully backed by physical assets. This mechanism meets the transparency and investor protection requirements under the EU MiFID II framework.

2. On-chain Issuance Layer: SPL/ERC-20 Multi-chain Deployment + Smart Contract Management

xStocks mainly adopts two types of issuance standards on-chain:

- Solana Chain (SPL): xStocks first deployed its stock tokens (such as xAAPL, xSPY) on the Solana network, leveraging its high throughput and low transaction cost advantages. SPL tokens natively support DeFi applications on Solana, such as Jupiter, Kamino, Marinade, etc.

- Ethereum Chain (ERC-20): To achieve cross-chain compatibility and multi-chain expansion, Backed also bridges tokens to Ethereum, Polygon, Avalanche, and other public chains through cross-chain protocols like LayerZero and Chainlink CCIP, providing support for CEXs and more DeFi platforms.

The lifecycle of each token (issuance, destruction, transfer) is controlled by on-chain smart contracts. These contracts verify the authorization status of the issuing SPV, the equivalence of custodial assets, and maintain synchronization between off-chain oracles and on-chain states.

3. Trading and Interoperability Layer: CEX, DeFi, Oracle Integration

xStocks not only supports direct transfers between on-chain wallets but is also integrated into multiple trading and financial protocols, offering high interoperability:

- Centralized Exchange (CEX) Integration: xStocks can be traded through supported exchanges like Bybit and Kraken, providing a familiar user experience for traditional users.

- Decentralized Finance Protocol (DeFi) Integration: Token holders can provide liquidity on Raydium, automate market making on Kamino, and use tokens as collateral for lending on MarginFi on Solana, further enhancing the on-chain utility of assets.

- Oracle Support: Leveraging Chainlink’s oracle system, xStocks can achieve real-time synchronization of prices, net asset values, and off-chain information. Through CCIP (Cross-Chain Interoperability Protocol), Backed can ensure token states are consistent across multiple chains, eliminating arbitrage opportunities.

Comparison of xStocks with Similar Platforms

Currently, there are mainly three types of stock tokenization solutions similar to xStocks in the market: Third-party Compliant Issuance (represented by xStocks, Dinari, etc.), Broker Self-operated Issuance (represented by Robinhood), and Synthetic Derivative Models (represented by CFDs and existing DeFi synthetic protocols). The following table briefly compares xStocks with some similar projects in terms of issuance mechanisms, backing assets, and technical architecture:

US Stock Tokenization Platform Comparison Table (Source: Gate Learn Creator Max)

Unlike decentralized synthetic asset protocols such as Synthetix and Mirror, xStocks adopts a 1:1 physical asset collateral model, with real stocks held by regulated custodial institutions, achieving direct pegging of token value to stock value. The former, such as mAssets and sTSLA, rely only on token staking and oracle pricing, lacking real asset backing, and carry higher risks, having gradually exited the mainstream market. DeFiChain’s dTokens are also synthetic assets, guaranteed by DFI, and although they access Nasdaq data sources, they still struggle to eliminate trust barriers.

In comparison, the xStocks model has significant compliance advantages: tokens are backed by auditable asset custody, with clear legal relationships, equivalent to holding debt equity in stocks. Additionally, xStocks combines on-chain DeFi functionalities, supporting market making and lending, with strong scalability. Compared to brokers like Robinhood, although the latter is also advancing on-chain issuance, there are obvious limitations in technical barriers and costs. In summary, xStocks achieves a balance between trust and usability with its “compliant third-party issuance + cross-platform access” model.

Introduction to Gate xStock Section

Gate’s xStock Section is a tokenized stock trading platform designed for crypto users, mapping the stock prices of well-known listed companies to on-chain assets through blockchain technology. Users can trade perpetual contract products of popular companies like Apple, Tesla, Google, Amazon using crypto assets (such as USDT) without opening traditional securities accounts. xStock products support bidirectional long and short operations, 1-10x leverage, and are open for trading 24 hours a day, combining on-chain transparency with contract flexibility to provide crypto market participants with a new way to participate in global technology assets.

Source: https://www.gate.com/trade/CRCLX_USDT

Select the xStock section in either Spot or Futures to enter.

Regulatory and Legal Challenges

US stock tokenization projects face complex regulatory issues in their global promotion. Within the United States, the SEC has not yet established a clear regulatory framework for stock tokenization, and discussions are ongoing about how to protect investor rights (such as dividends and voting rights) and trading systems (such as best execution rules). The Securities Industry and Financial Markets Association (SIFMA) recently publicly opposed granting regulatory exemptions to crypto platforms, arguing that any tokenized securities trading should comply with traditional securities laws. Meanwhile, SEC Commissioner Peirce has stated that they are researching possible exemption orders to allow the issuance and trading of securities using distributed ledger technology. Overall, the US regulatory environment is gradually becoming more open but still emphasizes equal treatment with existing brokers and exchanges, with market access requiring licensed brokers or completion through trading systems. Companies like Coinbase are also communicating with the SEC to seek approval for launching stock token services in compliance with regulations.

In the EU and other mature markets, tokenized securities are similarly regulated by existing securities regulations. The EU’s MiFID II and the upcoming MiCA regulations view tokenized stocks as securities, imposing similar access and disclosure requirements as traditional stocks. The EU has also launched the DLT Pilot Regime, providing sandbox-style support for eligible securities token trading, but full implementation still requires time. Asian financial centers like Singapore and Hong Kong are also actively formulating regulations: Singapore’s MAS has included tokenized RWA under securities law jurisdiction, while Hong Kong’s SFC allows compliant issuance through virtual asset trading platform licenses and STO sandbox systems. In emerging markets, policies vary greatly between countries: some countries encourage financial innovation and establish regulatory sandboxes (such as UAE’s VARA, Switzerland’s DLT Act), while others like China highly restrict crypto assets, essentially prohibiting tokenized securities business locally. Against this backdrop, most US stock tokenization products choose overseas issuance, restrict nationality (prohibiting US and Chinese investor participation), and rely on third-party compliance structures (such as custodial agreements, proof of reserves) to enhance regulatory trust.

Impact on Traditional Financial Ecosystems

The potential impact of US stock tokenization on traditional brokers, exchanges, and financial intermediaries is profound. On one hand, tokenization opens up a more convenient channel for global investors to invest in US stocks, allowing small and medium-sized investors and users from developing countries to participate in US stock trading without traditional brokerage accounts. This decentralized channel may divert some order flow from retail brokerage platforms like Robinhood and Schwab, forcing traditional brokers to accelerate digital transformation. For example, Robinhood itself has ventured into on-chain stock trading and plans to launch a dedicated Layer-2 network to support 24/7 trading.

On the other hand, tokenization reduces the role of traditional market clearing houses and intermediaries: on-chain atomic settlement can theoretically replace T+1, T+2 delays, putting pressure on intermediaries to restructure their business models. Furthermore, tokenized stocks are sparking new competitive landscapes. Global crypto exchanges (such as Gate) are attracting large amounts of capital that would otherwise enter traditional markets by promoting on-chain stocks. At the same time, DeFi protocols using stock tokens as collateral are spawning innovative products like on-chain lending and decentralized ETFs, further blurring the boundaries between traditional and crypto finance.

From a user behavior perspective, investors may increasingly favor products that enable cross-market diversification, such as buying US stocks with stablecoins or staking stock tokens to participate in DeFi yields. This interactive transformation has changed the way capital markets are participated in, with trends emerging where exchanges combine brokerage functions and platforms integrate trading and settlement. Overall, US stock tokenization may reshape broker profit models and improve trading efficiency, but it also poses new challenges for regulatory compliance and market stability.

Development Trend Outlook

Looking ahead, the development of the US tokenized securities market will be influenced by multiple factors including macroeconomic conditions, crypto market cycles, institutional participation, and technological advancements.

- From a macro perspective, if global economic or market volatility increases, high-liquidity and low-cost on-chain investment tools may attract risk-averse capital, while regulatory attitudes towards stablecoins and digital assets will indirectly affect the development of the tokenized market. The crypto market itself has cyclical nature: during bull markets, institutions and retail investors are more willing to try new financial innovations, while bear markets may delay the spread of such high-risk new products.

- On the institutional front, large asset management firms have begun to explore or issue on-chain securities (e.g., BlackRock, Prudential), and if more traditional brokers and funds participate in the future, it will significantly promote market maturity and scale.

- Technologically, the evolution of distributed ledgers and DeFi ecosystems (such as Layer-2 scaling, more efficient on-chain clearing systems) will lower the cost threshold for tokenization and improve user experience. Combining industry research and expert opinions, US stock tokenization has the potential to become a mainstream investment channel in the next 5-10 years.

The market is expected to develop towards compliance and standardization: clearer issuance and trading rules, more robust investor protection mechanisms; meanwhile, product categories will also become more diverse, not limited to stock ETFs, but potentially covering bonds, REITs, and other physical assets. Based on mature on-chain infrastructure, stock tokens may become an extension of traditional finance, making asset allocation more diversified and trading more efficient. However, large-scale popularization still depends on technological maturity and regulatory support, and once widely recognized, it may trigger new asset management innovations in the next economic cycle.

Share

Content