Behind SXT’s V-shaped reversal: When “trust” itself becomes a tradable crypto asset

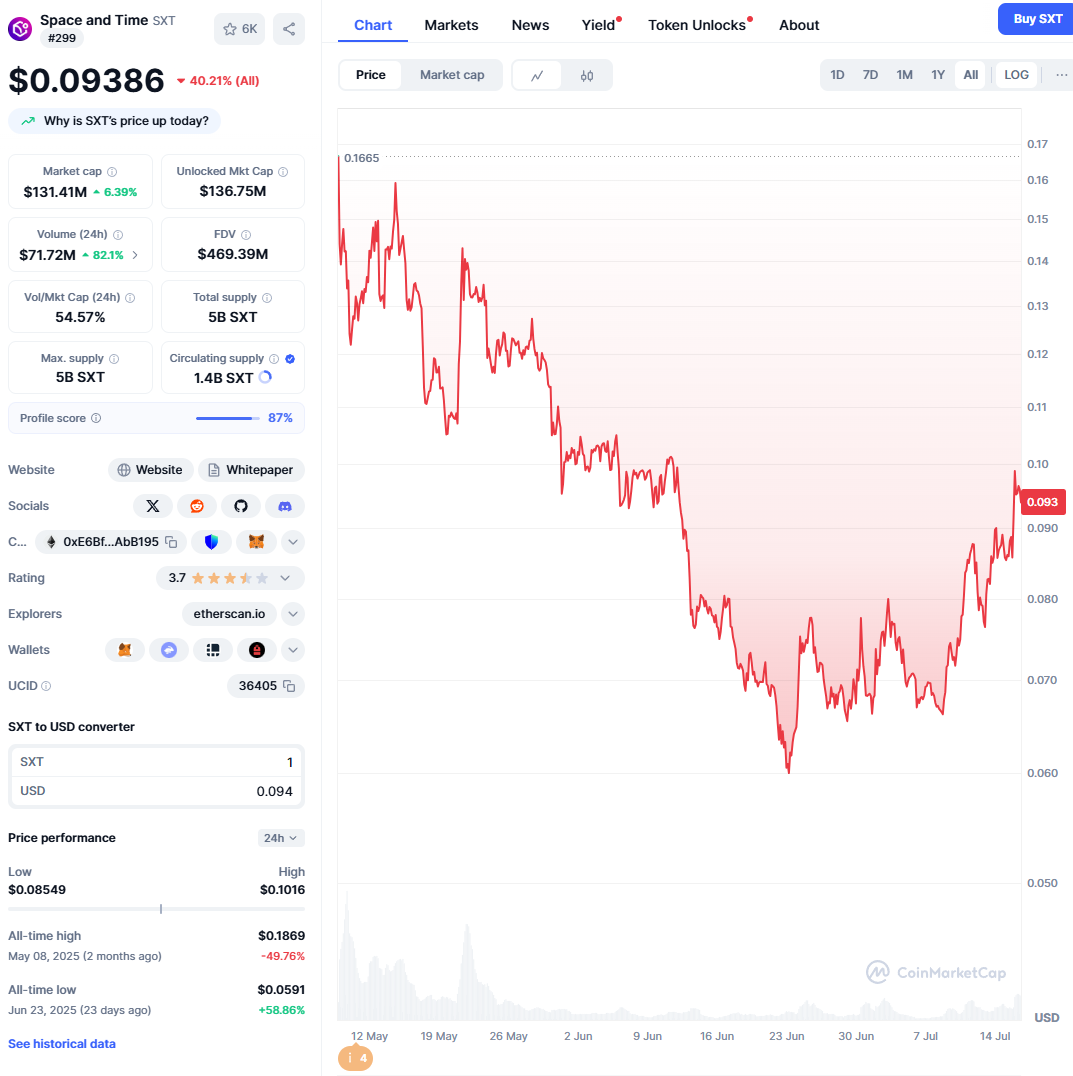

In the crypto world, dramatic price surges are commonplace, but certain reversal patterns—like deep-sea currents—hint at fundamental sector shifts. Recently, as most major assets consolidated, an unfamiliar token—Space and Time (SXT)—quietly drew a striking “V-shaped reversal” on its price chart. This move wasn’t driven by retail hype or the viral spread of a meme; the real catalysts were industry powerhouses: Grayscale and Microsoft, representing legacy finance and technology.

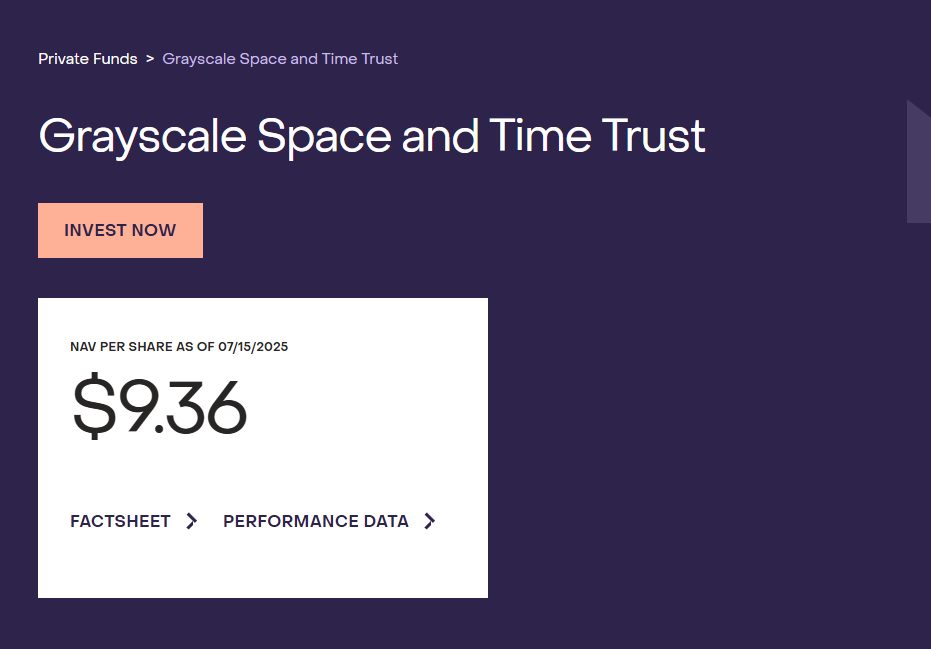

This reversal marks not just a price correction but a wholesale revaluation. It signals that the market’s most sophisticated capital has shifted its focus from chasing the next “100x” application-layer token to deeper, more resilient infrastructure. Grayscale’s launch of an SXT single-asset trust fired the starting gun on a grand experiment: forging “verifiable trust” into an institution-grade, investable asset. What you see on the SXT price chart is simply the first pulse of this transformation in public markets.

From “Data Warehouse” to “Trust Engine”: The Silent Infrastructure Revolution

How can smart contracts trust the outside world? By design, blockchains are closed, deterministic systems—a sterile lab that can’t directly or securely access the vast universe of off-chain data. This fundamental “data blindness” has long stifled the imagination of decentralized applications, making it difficult for dApps to realize their potential in data-intensive industries like finance, gaming, and AI.

For years, oracles have worked as “messengers,” partially solving the data input problem. But oracles mainly transmit information—they don’t guarantee the absolute trustworthiness of the underlying computation. Imagine a messenger telling you, “Today’s temperature is 86°F,” but you have no way to know if the figure comes from an accurate sensor or if the number was simply made up.

Space and Time (SXT) aims to solve this final “last mile” of trust. Instead of just building a decentralized data warehouse, it has developed a “verifiable trust engine” powered by a proprietary technology called “Proof of SQL.” This breakthrough merges cutting-edge zero-knowledge cryptography (ZK-SNARKs) with SQL—the database language that millions of developers worldwide rely on.

In the words of SXT co-founder and CEO Nate Holiday: “Enterprises want to move their business logic and data on-chain, but cost, storage, and compute constraints hold them back. Our solution seamlessly connects massive off-chain data processing to on-chain smart contracts, without any need for trust.” Put simply, SXT lets anyone run complex SQL queries on enormous off-chain datasets, then generate a tiny, cryptographically secure “receipt.” On-chain smart contracts can quickly and cheaply validate this receipt, trusting the query result as a mathematical certainty—without worrying about computation complexity or the trustworthiness of any server involved.

This is a paradigm shift: trust is moving from economic-incentive, probabilistic models to cryptographic determinism. This vision aligns with Ethereum founder Vitalik Buterin, who has repeatedly emphasized that ZK technology is the critical path for blockchain scalability and feature expansion—enabling networks to verify complex computations beyond their native processing ability, all while maintaining security.

Alliance of Giants

While SXT’s technology is its nucleus, the “alliance of giants” behind it—Microsoft, NVIDIA, and Chainlink—forms an unbeatable market force. Their backing explains why Grayscale could confidently introduce a dedicated SXT trust: this isn’t just a bet on a single innovation, but on a vertically integrated business ecosystem.

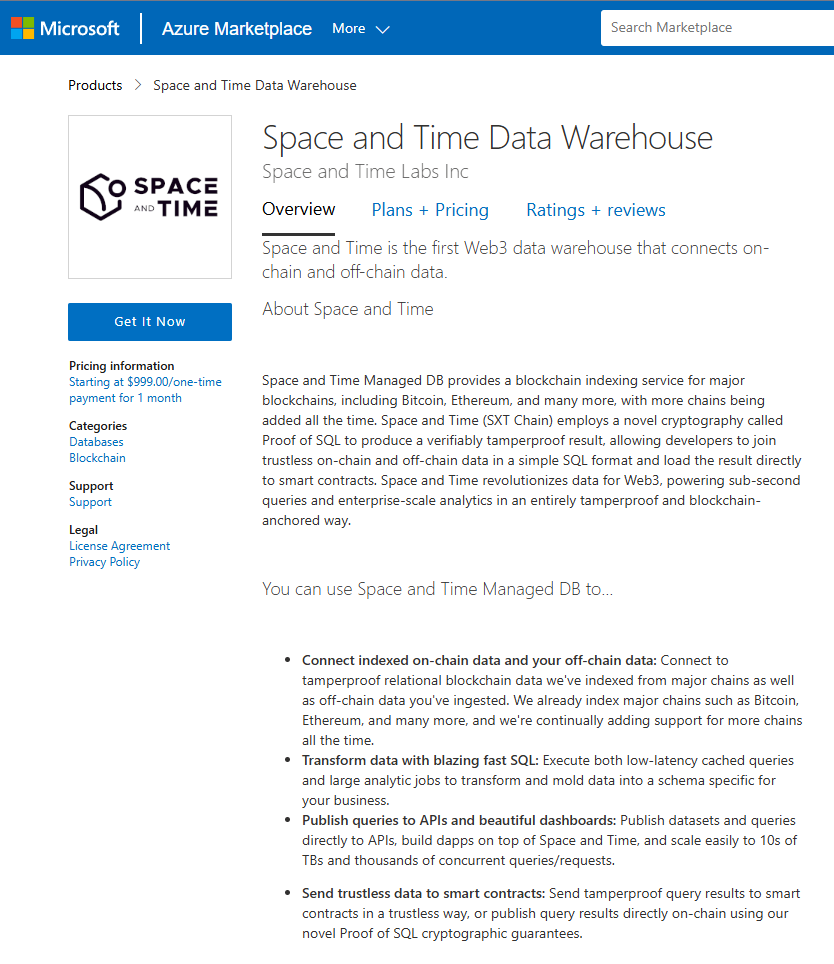

Microsoft is the “superhighway” to the enterprise world. Its venture arm, M12, led SXT’s strategic funding, and the partnership runs deep: SXT’s services are not only available on Azure Marketplace, but are natively integrated into Microsoft Fabric—the company’s flagship analytics platform—making SXT its first and only Web3-native data provider. This is a pure strategic alliance; neither party paid the other for the integration. Microsoft’s intent is clear: SXT is a strategic extension of its enterprise data ecosystem, injecting trusted Web3 data into its vast infrastructure—a Trojan horse in the best sense.

NVIDIA, the undisputed leader in AI hardware, provides the “compute engine.” Zero-knowledge proof generation demands massive computational power, and as part of the NVIDIA Inception Program, SXT benefits from NVIDIA’s global GPU dominance and top-tier AI ecosystem support. This partnership reveals SXT’s ambition: to become the trusted data hub at the intersection of AI and crypto.

Chainlink, the leading oracle provider, plays the “last-mile” delivery role. Deep integration ensures that SXT’s verifiable results can be securely and reliably delivered to any smart contract on any public blockchain. The result: a closed commercial loop—from NVIDIA’s raw compute, to SXT’s core logic, to Microsoft’s enterprise distribution, to Chainlink’s on-chain deployment.

When Infrastructure Becomes an Investable Asset

So, what does SXT’s “V-shaped reversal” really mean? After Grayscale launched its SXT trust and assets under management soared into eight figures—second only to XRP among its new launches—the market understood the message.

This is a “Davis Double Play” in capital markets: First, SXT’s technical value is recognized, with Proof of SQL positioned as a crucial Web3 solution. Second, and more importantly, its business model and strategic status are acknowledged. SXT is no longer just a “data project,” but a quasi-enterprise solution with the collective endorsement of both technology and financial giants.

Grayscale is “assetizing” infrastructure—taking the abstract concept of verifiable computation, leveraging its brand and regulatory pipeline, and packaging it as a compliant financial product for qualified investors. The message to Wall Street is unambiguous: investing in SXT is no longer about speculating on a risky startup, but about allocating to a foundational “digital commodity”—verifiable trust—for the future digital economy.

SXT’s price movement is now guided less by short-term retail sentiment and more by a broader valuation model: How much market share can it capture in the future enterprise data and AI computation sectors? When a project’s value shifts from “consumer” to “enterprise,” from “application” to “infrastructure,” both its price stability and growth potential transform. That’s the true story behind the “V-shaped reversal.”

When the noise settles, it won’t be faster chains or flashier apps driving the next wave of growth, but unseen foundational infrastructure that delivers the bedrock of trust for the digital world. Through the SXT Trust, Grayscale hasn’t just opened a door to the future for investors—it’s signaled a market-wide shift: Value will ultimately return to those who create trust, power applications, and connect the digital and real worlds. The era of capitalizing on trust is just beginning.

Statement:

- This article is a reprint from [MarsBit] and the original copyright belongs to [Oliver, Mars Finance]. If you have concerns about this reprint, please contact the Gate Learn team for prompt resolution according to our procedures.

- Disclaimer: All views and opinions expressed in this article are those of the author and do not constitute investment advice of any kind.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is specifically mentioned, these translations may not be copied, distributed, or plagiarized.