Articles

AllAltcoinsBitcoinBlockchainDeFiEthereumMetaverseNFTsTradingTutorialFuturesTrading BotsBRC-20GameFiDAOMacro TrendsWalletsInscriptionTechnologyMemeAISocialFiDePinStableCoinLiquid StakingFinanceRWAModular BlockchainsZero-Knowledge ProofRestakingCrypto ToolsAirdropGate ProductsSecurityProject AnalysisCryptoPulseResearchTON EcosystemLayer 2SolanaPaymentsMiningHot TopicsP2PSui EcosystemChain AbstractionOptionQuick ReadsVideoDaily ReportMarket ForecastTrading BotsVIP Industry Report

More

Gate Research: June Crypto Market Review

Download the Full Report (PDF)

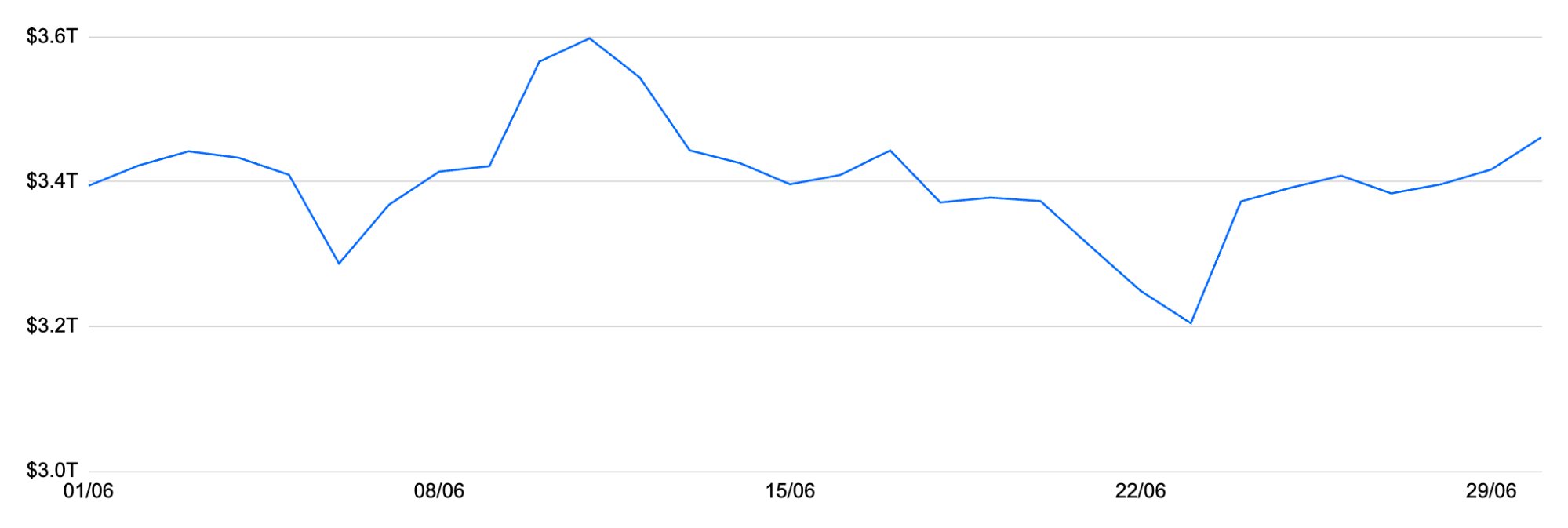

In June 2025, the total cryptocurrency market capitalization fluctuated between $3.2 trillion and $3.6 trillion, with geopolitical tensions in the Middle East temporarily weighing on market sentiment. Solana led with nearly 100 million daily transactions, followed by Base with 9.7 million. SEI surged in popularity, driven by price gains and favorable policy momentum—its daily trading volume exceeded $94 million in mid-June, with a short-term price increase of over 50%. Global crypto regulation showed growing divergence, Singapore tightened oversight of offshore services, the U.S. advanced stablecoin legislation, while South Korea and Vietnam adopted a more supportive stance. Overall, the regulatory climate showed signs of warming.Abstract

- Crypto Market Performance: In June 2025, the total crypto market capitalization remained range-bound between $3.2 trillion and $3.6 trillion. Geopolitical tensions in the Middle East temporarily pushed the market to the lower end of this range. Among the top 8 crypto assets by market cap, performance was mixed, with BTC leading the pack with a monthly gain of 3.42%, while altcoins generally underperformed.

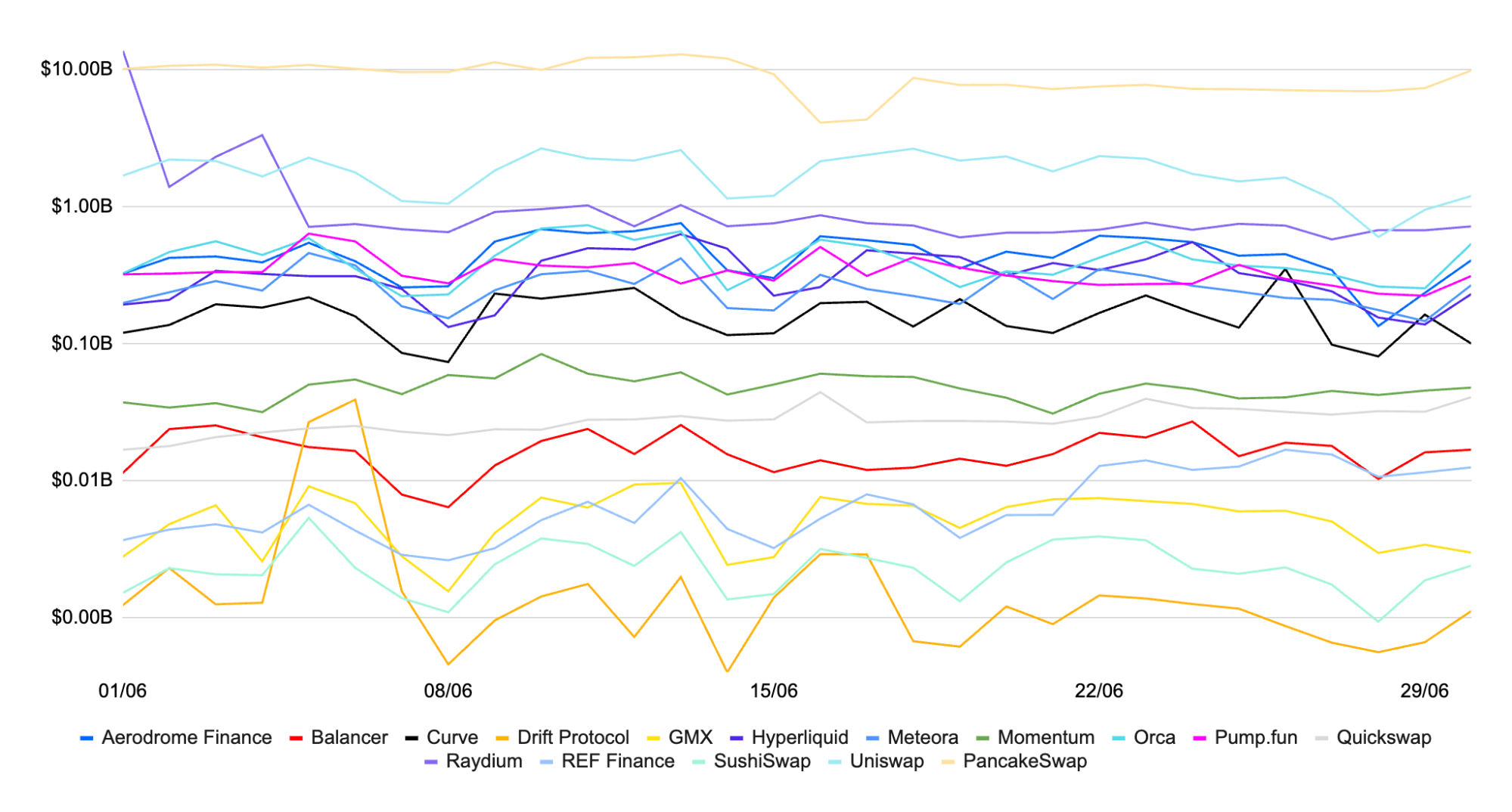

- On-Chain & DEX Data: Solana maintained its lead with an average of nearly 100 million daily transactions, followed closely by Base with 9.7 million. In the DEX sector, PancakeSwap led with an average daily volume of $8.9 billion, ahead of Uniswap ($1.816 billion) and Raydium ($1.339 billion), securing its position as the leading decentralized trading platform.

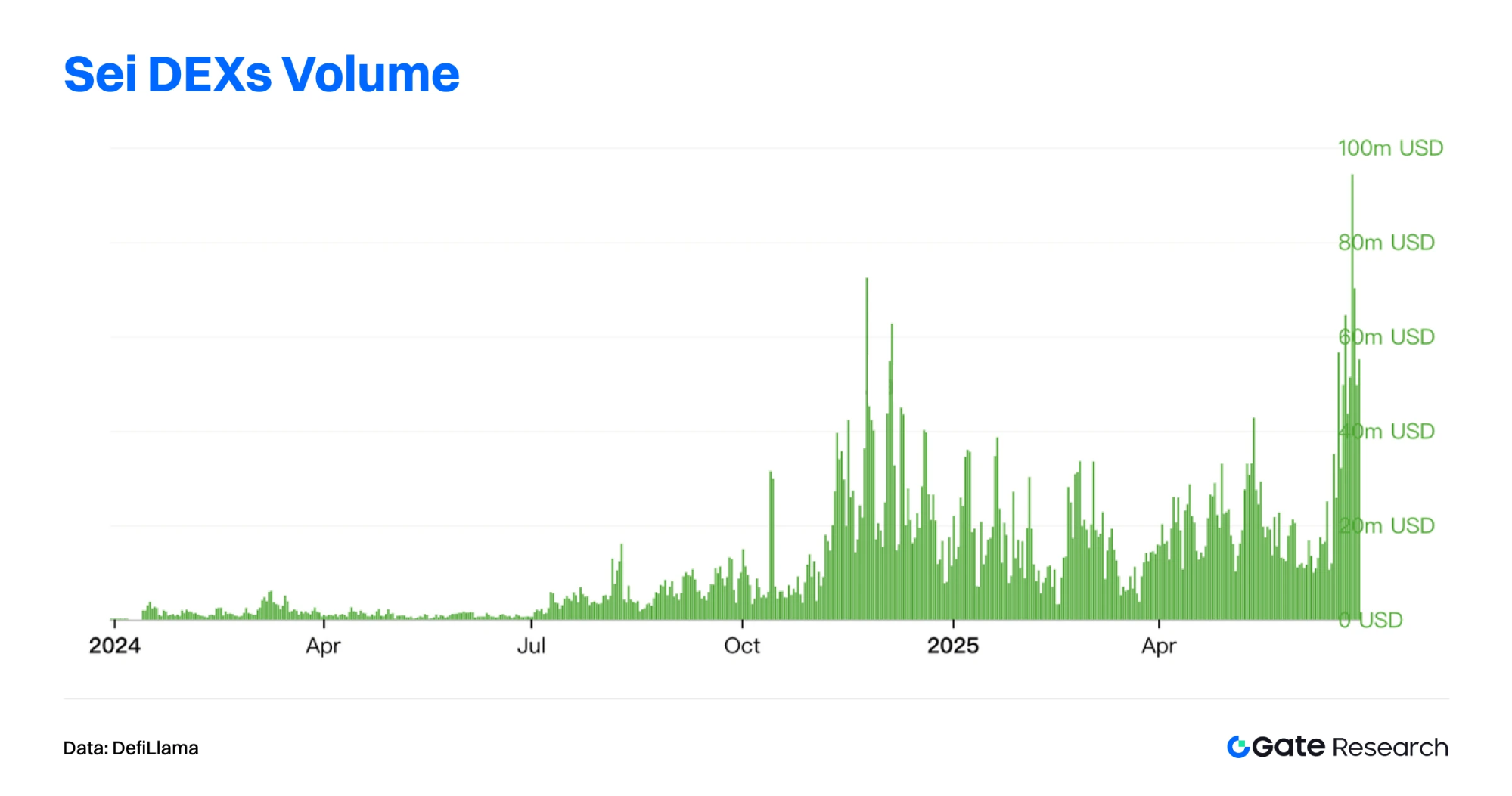

- Trending Projects: SEI surged in popularity due to price appreciation, favorable regulatory sentiment, and strong community momentum. In mid-June, its daily trading volume exceeded $94 million, with short-term gains of over 50%. Upcoming EVM upgrades and stablecoin pilot initiatives further enhanced its potential in compliant finance and cross-chain integration, pushing its engagement metrics to the forefront.

- Global Policy Shifts: In June, global crypto regulations continued to diverge. Singapore tightened oversight of offshore crypto services, while the U.S. advanced its stablecoin legislation. South Korea’s new administration showed strong support for domestic crypto development, and Vietnam officially recognized crypto assets as legal, signaling a generally friendlier policy environment.

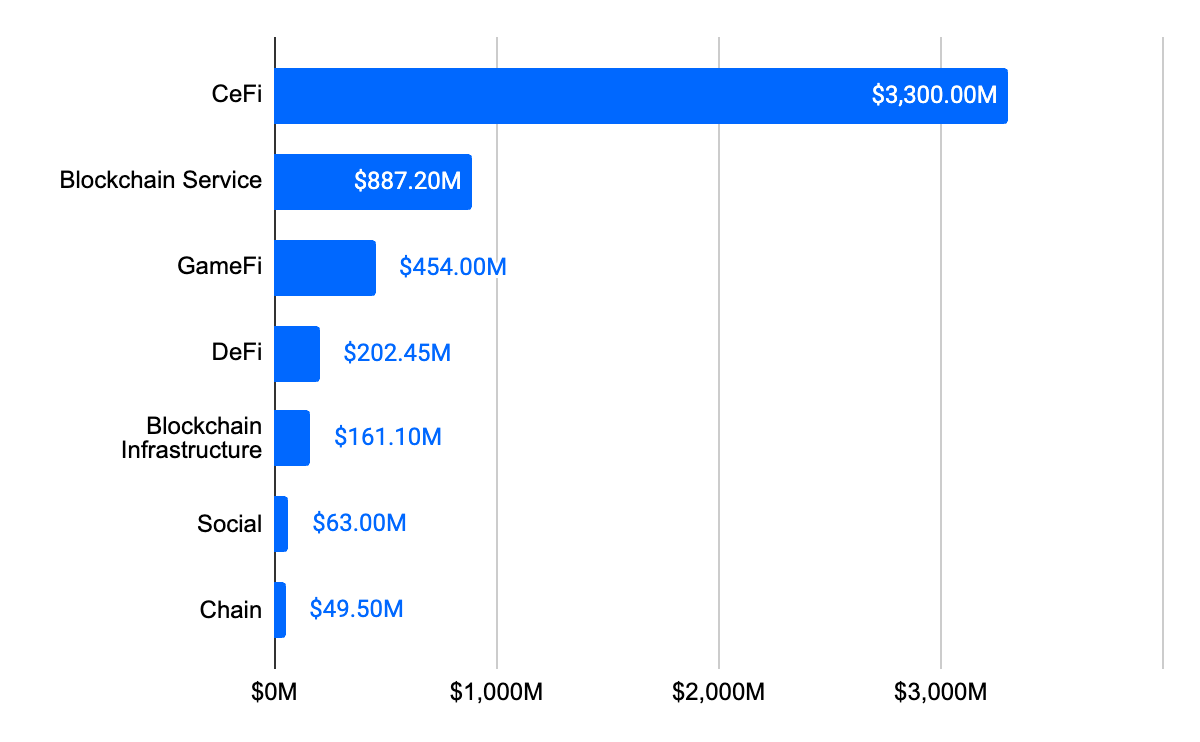

- Funding & Security Events: The Web3 sector recorded 119 funding deals in June, totaling $5.14 billion—a 167.7% month-over-month increase and the highest in 2025 so far. CeFi and blockchain services led the funding landscape. Reported security incidents resulted in approximately $114 million in losses, mainly due to account breaches and smart contract vulnerabilities.

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Author: Mark, Shirley, Ember

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Share

Content

Start Now

Sign up and get a

$100

Voucher!