How To Retire Off Memecoins

In this guide, I’m going to share my exact plan to retire this cycle off memecoins this cycle. No, I’m not joking.

I’ve spent the past 1-2 years stacking memecoins on Ethereum. I’ve bought every dip and accumulated with no intention of selling anytime soon. Memecoins now make up 80% of my portfolio.

I’ve also been gradually selling my Solana memecoin holdings. The ecosystem has become increasingly extractive. Besides a few outliers, returns in the trenches have been diminishing since $TRUMP and $MELANIA launched in January.

The Solana trenches will never die. There will be an endless supply of new memecoins pumping and dumping every day. But there are much safer, better returns to be found elsewhere.

At a high-level, my memecoin strategy is simple:

❌STOP: Spraying and praying for 100x gains on illiquid Solana memecoins.

✅START: Chasing 10-20x gains on liquid Ethereum memecoins with size.

Part I — Why Ethereum Memecoins?

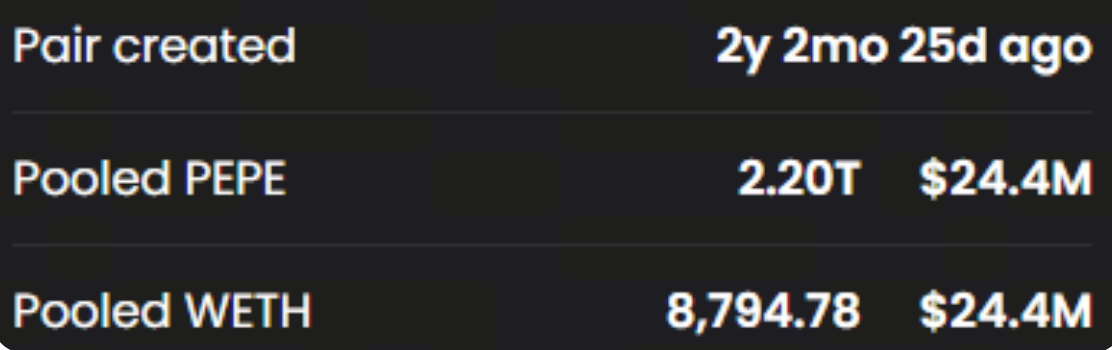

There’s $49M of liquidity in the PEPE/ETH pair. What do you think will happen to the price of $PEPE when $ETH doubles or triples?

My thesis is simple:

$ETH will pump.

Memecoins will pump harder.

We’ve already seen outsized returns from memecoins like $PEPE, $MOG and $SPX in the past 1-2 years. These coins have outperformed $ETH in price action and will likely continue to do so.

If an Ethereum memecoin meets the following criteria, put it on a watchlist and keep an eye on it:

- 1+ years old

- $500K+ in locked/burned liquidity

- Contract ownership renounced

- Website and socials are still hosted

- Some activity from holders on Telegram or Twitter

These coins will significantly outperform $ETH in an alt season. Which is much closer than you think.

Also, Etheruem memecoins have a hidden benefit. They’re compatible with DeFi. More on this later.

Now for the part everyone’s waiting for.

Part II — Price Targets

The part everyone cares about: price targets. Feel free to screenshot.

Nobody has a crystal ball. No one can tell you exactly where prices are heading. However, you can make an educated guess based on a variety of metrics.

Remember: regardless of whether or not you actually like the coin or resonate with the meme, almost all of these coins will go up in a bull run.

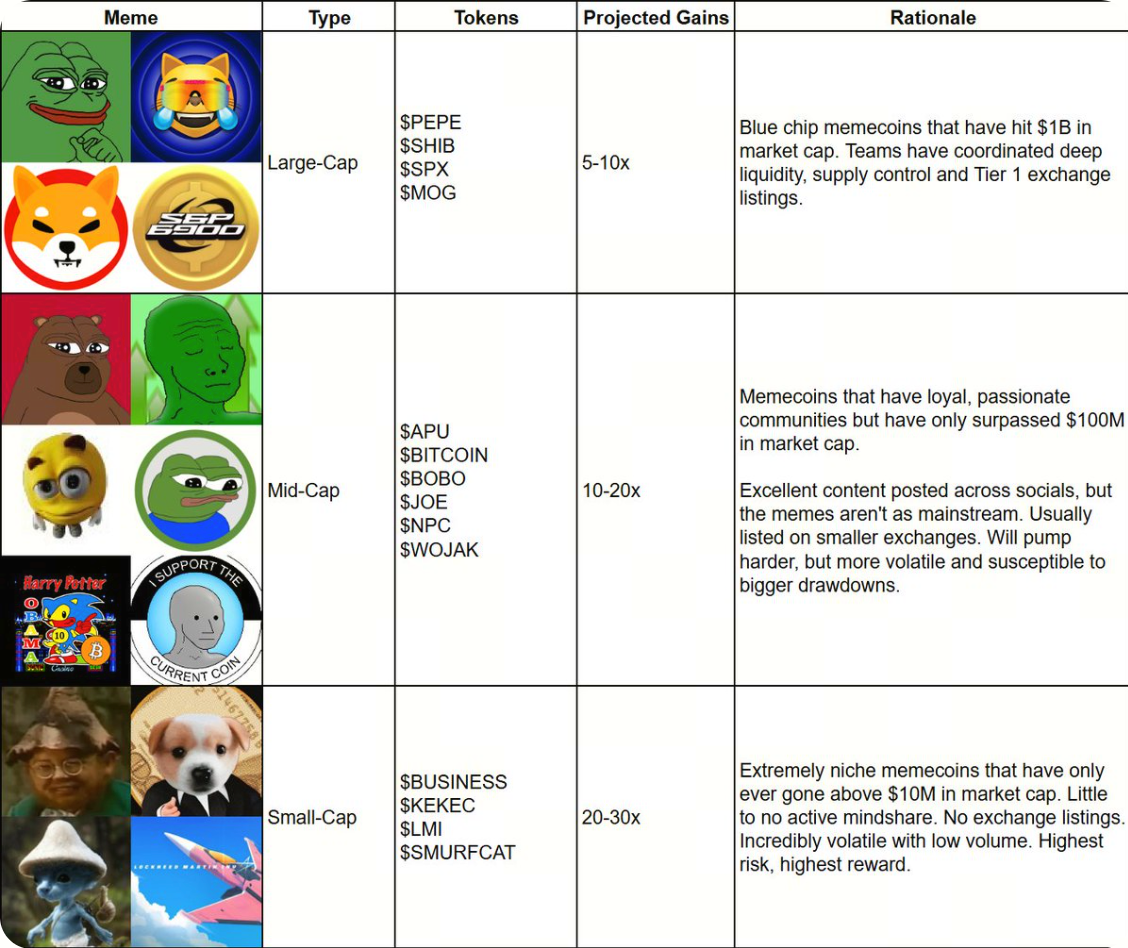

Let’s start first with your Large-Caps:

I classify a Large-Cap as any memecoin that’s hit $1B MC before. At these price levels, these are your reliable 5-10x gains.

You should sleep comfy at night holding these coins. 90% drawdowns are almost completely off the table unless something disastrous happens, which is highly unlikely given their size.

Further down the risk curve, you have your Mid-Caps:

These are coins that have cracked $100M MC before. They’re usually listed on Tier 2 exchanges, have active communities and dedicated holders. You can forecast these mid-caps to 10-20x from current prices.

Finally, you have your Small-Caps:

These are bottom-of-the-barrel memecoins that have only ever surpassed $10M in market cap. No exchange listings, less volume and liquidity but way more volatility. Not all of these will pump, but those that do could potentially see 20-30x gains.

Your portfolio should be weighted heavily towards blue chips, moderately towards mid-caps and a few speculative small-caps for fun.

Part III — Spot Leverage

Don’t let anybody tell you your memecoins aren’t worth real money.

Now that you’ve bought your memecoins, what comes next?

You can now use memecoins in DeFi.

A protocol called the IMF, the International Meme Fund @intlmemefund, lets you borrow and lend against your memecoins.

Why would you use the IMF to take out a loan against your memecoins?

I used it to get spot leverage on my holdings. For every $1 that my memecoins go up, I now make $1.50.

Here’s how it works:

- Buy $10K $PEPE

- Deposit $PEPE into the IMF and take out a $5K $USDS loan

- Swap the $USDS for $PEPE

- Deposit the remaining $5K $PEPE to lower your LTV

You now have 1.5x the amount of $PEPE. You only face a liquidation if the price of $PEPE falls 66% from it’s current price, which is becoming less likely each day.

A healthy bit of leverage goes a long way. You can sleep tight with 1.5x exposure to $PEPE.

You also farm $IMF rewards when you do this trade, so it’s a win-win.

I didn’t see or understand the potential of the IMF at first. But instead of selling, communities like $MOG and $JOE are buying more of their own coin and pushing it higher with new buying bower.

The IMF currently supports $PEPE, $MOG and $JOE, but more coins are on the way soon.

But what about futures or perpetuals trading on Binance, ByBit and Hyperliquid?

I recommend exercising caution. Memes on Ethereum are more mature and take longer to pump. It’s largely a patience game. A matter of when, not if.

If you’re going to swing-trade, stick to low leverage, have a longer-time frame, and never put in more than you’re willing to lose.

Part IV — Exit Strategy

Riding off into the sunset.

The last part is the easiest.

Your bags are packed. Not to just sit on your hands and wait.

Memecoins on Ethereum will have their time. Everything moves in cycles and the rotation back to Ethereum memecoins is imminent.

Regardless, it’s important to set hard targets of when to take profit. Without a plan to sell a % or $ amount of your memecoins, you’ll likely roundtrip it.

When your coins start pumping, start off by paying off your loans on the IMF and reducing your spot leverage.

Then use a protocol like @1inch or @CoWSwap to DCA (dollar-cost average) out and exit across multiple positions.

Don’t try and time a perfect exit at the top. You’ll instead want to take profits in small clips as your coins go up. Gas on Ethereum mainnet is cheap, so split your sells across as many transactions as you need.

Once you’ve done this, congratulations.

You’ve successfully caught the bull run and retired off memecoins.

Conclusion

I must live a certain way.

Memecoins are here to stay.

While I’m bullish on other crypto assets I own, including NFTs and some Solana memecoins, I strongly feel memecoins on Ethereum are a beach ball underwater.

We’ve already seen $MOG and $JOE pump in bearish conditions and rebound off their February lows.

With DeFi protocols like the IMF introducing lending and spot leverage into the mix, I don’t see how another meme season isn’t right around the corner.

This time, instead of trying to aggressively trade new coins, I’m sticking to the old and trusted ones.

Thank you for reading How To Retire Off Memecoins.

To stay updated on my future posts, make sure you’re following me on Twitter and join my Telegram.

Until next time,

— NEETOCRACY

Disclaimer:

- This article is reprinted from [NEETOCRACY]. All copyrights belong to the original author [NEETOCRACY]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.