PayFi: The DeFi Settlement Infrastructure Connecting the Crypto World with Real-World Payments

I. Introduction: The Next Frontier of DeFi Payments

Over the past five years, stablecoins have steadily been serving as a key bridge between crypto assets and traditional finance. From cross-border payments to on-chain trading, asset custody to value preservation, stablecoins are redefining the concept of “money” in the digital era. In DeFi, stablecoins act not only as essential liquidity sources but also play a key role in ongoing experimentation with on-chain payments. However, extending crypto’s utility to real-world payments still faces several significant challenges:

- Fragmented payment infrastructure: Users and merchants operate across different chains, wallets, and stablecoins, leading to poor interoperability.

- High costs: On-chain transactions are often constrained by limited scalability and volatile gas fees.

- Lack of unified liquidation settlement: Cross-chain fund movement typically depends on centralized exchanges or bridges, which may raise trust concerns.

- Compliance complexity: Executing payments across jurisdictions involves navigating complex AML and KYC requirements.

Traditional Web2 payment systems benefit from unified liquidation networks, robust compliance structures, and tight integrations at the merchant level. While Web3 lacks this level of coordination, making it difficult for DeFi payment protocols to bridge the “last mile.”

PayFi was created to close this gap. Built around stablecoins, it introduces a modular payment infrastructure focused on liquidation, cross-chain routing, and compliance, combining the flexibility of DeFi with the efficiency of Web2 payment systems to provide a new foundation for global payments.

II. What is PayFi?

1. Protocol Definition

PayFi is an on-chain settlement and payment layer that connects stablecoin issuers, cross-chain liquidity providers, DeFi protocols, and merchants through standardized modules and compliance-ready interfaces.

PayFi is more than a wallet or a payment DApp. It is designed to be a comprehensive settlement infrastructure, aiming to become the “SWIFT + Visa” of blockchain space.

2. PayFi’s Core Goals

- Unify fragmented payment routes across chains.

- Reduce payment costs and improve liquidation efficiency.

- Provide compliance frameworks to support global regulation.

- Support multi-chain, multi-asset payments for both users and merchants.

- Establish standardized liquidation logic as the foundation for DeFi protocol settlements.

3. Key Roles

PayFi’s key role summary table (Source: Gate Learn creator, Max)

These roles operate within a modular framework to form a flexible and composable open settlement network.

III. PayFi’s Technical Architecture and Core Mechanism

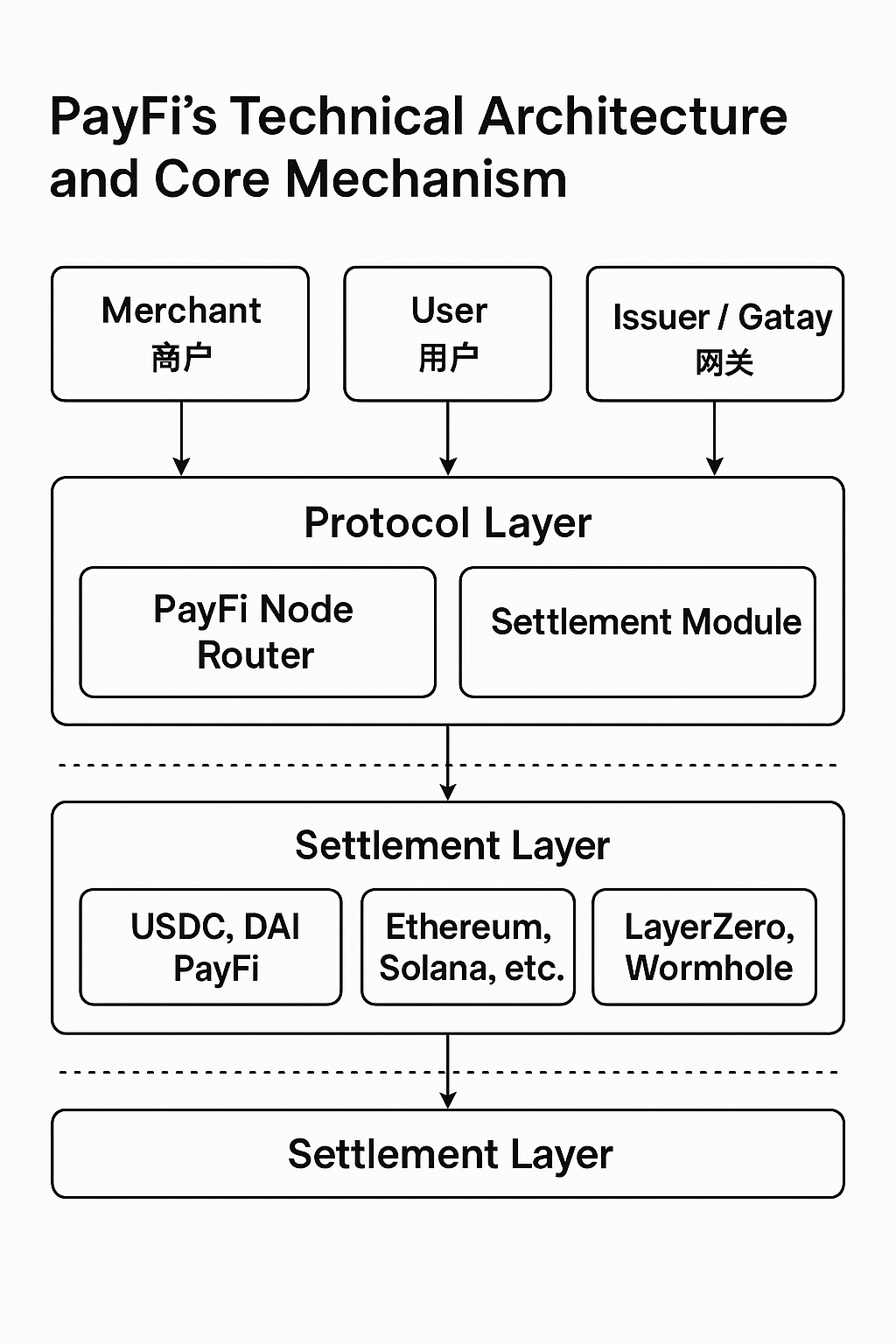

PayFi is built with a modular structure that supports cross-chain compatibility and compliance adaptability. It caters to user demands for smooth payments while addressing merchant needs for reliable clearing, liquidity access, and regulatory transparency. The system consists of three layers: Application Layer, Protocol Layer, and Settlement Layer.

1. Architecture Overview

PayFi architecture diagram (Source: Gate Learn creator, Max)

The overall system is structured into three layers:

- Application Layer: Interfaces for wallets, merchant tools, on/off-ramps, and other user- or enterprise-facing platforms.

- Protocol Layer: Includes the payment router, liquidation engine, and compliance modules.

- Settlement Layer: Connects to base infrastructure like public chain assets, stablecoin issuers, and bridge networks.

This layered design supports flexible deployment across different chains and business contexts.

2. Three Core Modules

a. PayFi Router: Cross-chain Routing & Liquidity Aggregation

Acts as the network’s “dispatcher,” which automatically determines the optimal payment path across chains. Its core logic includes:

- Supports cross-chain conversions, such as USDC on Optimism → USDT on Solana.

- Aggregates state and price data from multiple bridge protocols to enable dynamic route evaluation.

- Prioritizes paths based on liquidity depth, estimated slippage, and execution costs.

The Router functions much like a flight scheduling system, enabling efficient and automated value transfers across assets and blockchains.

b. Settlement Module: Efficient On-chain Liquidation Engine

Once payments are initiated, this module handles final liquidation and reconciliation to ensure accurate fund delivery.

- Batch clearing: Consolidates multiple small payments into fewer transactions to reduce costs.

- Zero-knowledge support: Enables privacy-preserving settlement workflows.

- Programmable strategies: Offers flexible models such as T+0, scheduled, or conditional liquidation.

This module is particularly well-suited for high-frequency micropayments, e-commerce settlements, and cost-sensitive operations.

c. Compliance Layer: Flexible Compliance Engine

To support global use, PayFi includes a modular compliance interface that supports:

- Identity verification for users and merchants (KYC/KYB).

- Blocklist/Allowlist screening for wallets and funds flow.

- Jurisdiction-specific regulatory adaptation.

This layer can integrate with on-chain reputation systems, third-party audit APIs, and off-chain AML/KYC providers to meet evolving compliance requirements.

3. Multi-chain, Multi-asset Compatibility

PayFi supports major blockchain ecosystems and assets, offering a unified experience across the following:

- Major chains: Ethereum, Arbitrum, Optimism, Polygon, Solana, Sui, TON, Aptos, etc.

- Stablecoins: USDC, USDT, DAI, EUROC, PYUSD, and the upcoming native stablecoin PUSD.

- Native assets: Supports direct payments with ETH, SOL, APT, and others, with built-in conversion.

- Fiat integration: Works with fiat on/off-ramp services, connecting to bank accounts and third-party payment systems.

This architecture ensures PayFi delivers a consistent and global payment experience across diverse blockchain environments.

4. Coordination with Cross-Chain Protocols

PayFi is built on various cross-chain communication protocols, treating them as underlying communication infrastructure. The specific collaboration is as follows:

- Using LayerZero, Wormhole, Axelar, and other protocols as communication bridges to transmit cross-chain asset messages.

- Implements its own settlement logic, independent of centralized components from bridge providers.

- Switches flexibly between bridges to maximize liquidity efficiency.

This model implements the concept of an “abstract bridge layer,” treating bridge protocols as internal infrastructure, which is not something exposed to end users or developers.

5. Capturing Time Value in Payment Paths

PayFi enables capital in transit to generate value during the settlement process. For example:

- While awaiting merchant settlement, assets can be temporarily allocated to DeFi protocols to earn yield.

- Enterprise cross-border payments can be completed in minutes, reducing the need for pre-funded reserves.

- On-chain payment records can serve as credit data to mint “receivables NFTs” for use in collateralized lending.

In this way, PayFi not only transfers assets, but also embeds the optimal scheduling and value capture mechanism of capital flow in the payment path.

6. Example Scenario

Imagine you are in Singapore, using USDC on Solana to buy a cup of drip coffee from a German cafe, but the other party only accepts DAI on the Arbitrum chain.

Without PayFi, you’d have to manually swap tokens, transfer across chains, and use intermediary services, which are complicated and costly.

With PayFi:

- The system automatically finds the optimal route (e.g., Solana → Ethereum → Arbitrum).

- Handles asset conversion and liquidation.

- The merchant instantly receives DAI; the user just taps “Pay.”

Just like paying with a credit card, except everything happens on-chain. It’s fast, accurate, compliant, and completely seamless.

IV. Typical Scenario Cases: Who Uses PayFi?

PayFi isn’t designed for a single vertical, it addresses the broader challenge of on-chain payment settlement. Its modular architecture makes it adaptable to a wide range of scenarios. Whether improving the cross-chain payment experience for individuals or powering automated settlements between enterprises and protocols, PayFi serves as a neutral infrastructure layer that fits seamlessly into diverse environments.

Here are some representative cases and the logic behind them:

1. E-commerce Payments: Where Stablecoins Show Their Strength

- Typical scenarios: NFT marketplaces, digital goods platforms, content creation websites.

- Usage: Merchants integrate PayFi’s payment API, allowing users to pay with stablecoins from any supported chain in a single click.

- User experience optimization: For instance, a user pays with USDC on Solana, and the merchant receives DAI on Arbitrum, no manual swaps or cross-chain transfers needed.

- Value delivered: Automatic routing across chains, fast payment confirmation, and stable, reliable settlement.

2. Stablecoin Settlement: The Liquidity Hub for Multi-chain DeFi

- Typical scenarios: Decentralized exchanges (DEXs), yield aggregators, lending protocols, facilitating stablecoin conversion and settlement across chains.

- Usage: DeFi protocols invoke PayFi’s routing and liquidation logic to automatically swap and reconcile assets across multiple blockchains.

- Advantages: Reduced slippage, lower settlement costs, seamless liquidity migration with minimal friction.

- Value delivered: Improved protocol coordination, optimized capital turnover, and more efficient operations.

3. Payments for Global Freelancers and Remote Work

- Typical scenarios: Remote work platforms, content bounty systems, freelance payment services.

- Usage: Platforms use PayFi to distribute salaries or bonuses globally, with users free to receive payment in their preferred stablecoin on any chain.

- Technical highlights: Supports multi-chain distribution, scheduled payroll, and instant confirmations.

- Target users: Web3 companies, DAO organizations, and creator economy platforms.

4. Offline Web3 Merchant Payments

- Typical scenarios: Crypto event booths, themed cafés, branded retail stores.

- Usage: Merchants integrate POS or wallet systems compatible with PayFi, enabling customers to pay with stablecoins from any chain by scanning a QR code.

- Settlement logic: Automatically converts and settles payments into the merchant’s preferred chain and token, no manual steps required.

- Target users: Brands, event organizers, and payment hardware providers.

5. Enterprise-grade Billing Settlement & Financial Automation

- Typical scenarios: Cross-border SaaS platforms, supply chain networks, data API service providers.

- Usage: Enterprises leverage PayFi to settle recurring fees and automate large-scale B2B reconciliations.

- Key capabilities: Supports batch payments, on-chain invoice mapping, and compliance reporting.

- Target users: Web3-native enterprises, digital platforms, and distributed team accounting systems.

6. Scenario Classification & Value Summary

Application scenario classification table (Source: Gate Learn creator, Max)

7. Summary

PayFi abstracts the complexity of cross-chain payments and provides a unified, programmable liquidation system for both users and businesses. From the user’s perspective, it hides complicated inter-chain conversion and asset exchange; from the developer or merchant’s perspective, it provides a set of standardized and composable payment liquidation and settlement services.

In its final form, PayFi may be invisible to the user; as long as payments flow as seamlessly as they do on Web2 networks, its infrastructure fulfills its purpose.

V. Development Path and Future Outlook

As an on-chain payment and settlement protocol, PayFi’s growth won’t happen overnight. It will progress alongside the expansion of multi-chain ecosystems, the growing use of stablecoins, and the evolution of regulatory frameworks. PayFi is currently in its initial protocol-building and integration phase. Over time, it will move from technical refinement and ecosystem expansion to open governance, becoming a core part of on-chain financial infrastructure.

1. Current Stage: Protocol Deployment and Early Integration

PayFi has completed its core protocol design and built the essential modules, with a focus on:

- Deploying key components like the payment router, settlement engine, and compliance interface.

- Testing multi-chain integrations, supporting asset routing across Ethereum, Arbitrum, Optimism, Solana, and more.

- Onboarding early merchants and platforms such as e-commerce sites, freelancer platforms, and Web3 content services.

- Releasing SDKs and APIs to help developers integrate PayFi into their DApps.

- Conducting security audits and preparing compliance frameworks for various jurisdictions.

The main goal of this phase is to validate PayFi’s technical approach and ensure stability in real-world payment scenarios.

2. Mid-Term Development Plan: Feature Expansion and Ecosystem Growth

Over the next 6–12 months, PayFi will focus on enhancing its protocol and expanding its ecosystem through several key initiatives:

a. Expanding Supported Assets and Chains

Adding more stablecoins (e.g., PYUSD, GHO, LUSD) and native tokens.

Supporting additional high-performance chains like Base, zkSync, Scroll, Sei, and Aptos.

Enhancing compatibility with cross-chain bridge protocols like LayerZero, Wormhole, and Axelar.

Launching PUSD, its native settlement asset, to streamline internal clearing.

b. Growing Ecosystem Partnerships

Building settlement channel partnerships with stablecoin issuers to boost adoption.

Developing “Payment-as-a-Service” solutions for e-commerce and subscription platforms.

Integrating PayFi payments into Web3 wallets like Phantom, Rainbow, and OKX Wallet.

Supporting Web3 POS, QR code scanning payment, and other terminal integration solutions.

c. Launching PayFi Wallet and User Tools

Releasing the PayFi Wallet app and browser extension for one-click on-chain payments and asset routing visualization.

Adding features like payment history, compliance report downloads, and route queries.

Supporting multi-user permission management for corporate treasury needs.

3. Long-Term Vision: Becoming the On-chain “Liquidation House” with Decentralized Governance

In the long run, PayFi aims to go beyond being a payment network, it seeks to become the clearing layer for on-chain finance and set new standards for blockchain payments.

a. Settlement Hub Role

Complete the on-chain process of liquidation and settling assets through “multi-chain → unification → redistribution” steps.

Aggregating liquidity to facilitate efficient cross-chain transfers.

Delivering a unified payment experience for protocols, platforms, and chains alike.

Extending to use cases like on-chain receivables, cross-border settlement, and supply chain finance.

b. Building Governance and Incentive Systems

Introducing a governance token ($PAY) and community-driven decision-making.

Creating stablecoin liquidation pools to incentivize optimal liquidity pathways.

Launching the PayPoint rewards system for active users, merchants, and ecosystem partners.

Establishing a “path validator” role where the community verifies routing efficiency via oracles.

c. Bridging with the Real World

Integrating with regulated custodians and fiat on/off ramps to connect to off-chain settlement systems.

Developing on-chain credit models to help enterprises manage financing and receivables.

Balancing transparency and compliance with privacy technologies like ZK settlements and ASP verification.

Ultimately, PayFi will not be confined to a single chain or ecosystem but will evolve into a global, multi-chain, compliant, and highly efficient decentralized settlement network.

4. Summary

PayFi follows a clear, step-by-step growth plan. Its goal isn’t to disrupt the traditional financial system overnight, but to steadily embed itself into on-chain payment and settlement processes through a modular, composable approach. By connecting assets, routing paths, and identities, PayFi aims to become the payment infrastructure layer powering the next-generation Web3 economy.

With its mainnet launch and token incentives, PayFi is entering a phase of accelerated adoption, addressing real-world needs in stablecoin payments, on-chain liquidity, and the integration of crypto payments into everyday commerce.

VI. Conclusion: A New Payment Infrastructure for Web3

As Web3 evolves, DeFi has gradually moved from initial lending and trading to a wider range of value circulation and real-world integration scenarios. On-chain payment, as a key path connecting on-chain capital with the real economy, must solve a series of structural problems such as efficiency, cost, compliance, and interoperability.

PayFi is not just another wallet or payment app. It redefines payment infrastructure by offering modular design, cross-chain compatibility, and built-in compliance. By integrating stablecoins, settlement engines, routing algorithms, and identity tools, PayFi creates a clearing network that supports both real-world commerce and the DeFi economy.

1. PayFi’s Value Proposition

Efficiency First: Smart routing and batch clearing optimize payment speed and capital utilization.

Cost Optimization: Aggregated cross-chain bridges and stablecoin liquidity minimize slippage and fees.

Compliance Neutrality: Modular compliance layers support global deployment and expansion.

Decentralized Scalability: Open growth through governance, incentives, and composable infrastructure.

2. What It Means for Users

For individual users and merchants, PayFi is not something they need to learn, it’s an invisible optimization system. Users will be able to complete on-chain payments as smoothly as using a credit card, without having to understand complex cross-chain routing, asset swaps, or compliance requirements.

This means that for the first time, ordinary people will find that “spending cryptocurrency in daily life” is practical, simple, and efficient.

3. What It Means for the Ecosystem

For developers and protocols, PayFi offers a composable payment layer that can serve as a liquidation engine for DApps or an enterprise payment gateway. It builds a unified value network across chains, breaking down the barriers that fragment today’s Web3 payment landscape. In the long term, PayFi has the potential to become Web3’s payment highway, much like Visa and SWIFT-shaped global finance, creating the core rails of the on-chain economy.

PayFi is not just a product; it represents a new paradigm, bringing payments out of isolated blockchain silos and into seamless integration with the real world.