XRP Hits New Highs: The Parallel Crypto Universe Behind a Veteran Token’s Surge

In every cycle of the crypto market, certain familiar names consistently reappear at the top of the gainers’ list.

XRP, XLM, ADA—projects that mainstream crypto communities often label as “obsolete” continue to make a comeback with each new bull run.

These aren’t newly launched, cutting-edge blockchains or the trendiest narratives capturing today’s spotlight. Nor do they boast powerful ecosystems or groundbreaking technical advancements. Yet, at distinct points in every bull market,

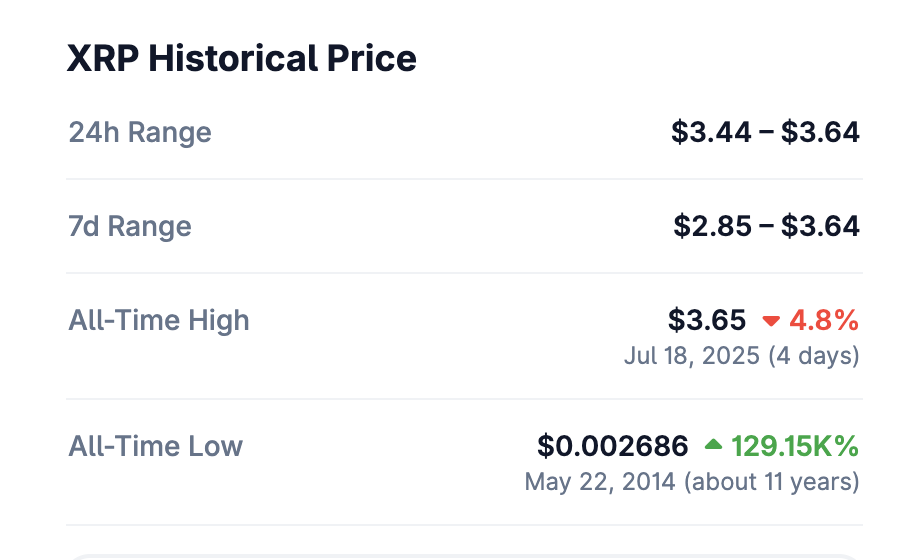

they manage to surge against the current, reclaim community attention, and in cases like XRP, even set new all-time highs.

This isn’t just market “speculation inertia”—it’s as if the crypto industry contains its own hidden parallel universe.

In this alternate world, XRP represents the future of cross-border payments, XLM stands as the hope for global micro-payments, and ADA is seen as the new order for smart contract governance.

Old coins never die; their endurance speaks volumes.

A Parallel Crypto Universe

If the crypto market is a stage filled with ever-shifting narratives and innovation, the true habitat of legacy coins lies behind the curtain—in a world running parallel to mainstream crypto communities.

We’re used to discussing the latest narratives and projects on Twitter, Discord, Telegram, or WeChat. We follow the rotating spotlights on Ethereum, Solana, or the latest meme coins.

Yet, we rarely realize that these so-called “legacy tokens” each have their own vast, stable communities operating outside our familiar circles.

XRP, XLM, ADA, HBAR—users of these coins are neither active on Crypto Twitter nor pursuing influencer endorsements.

They rely on their own information channels, community networks, and reasoning. In short, they have little regard for whatever is currently trending in the industry.

The XRP community thrives on WhatsApp and LINE in Japan and Latin America, and in Facebook groups across the United States.

Most of these users aren’t concerned with blockchain technicalities or the latest industry hotspots. They’re well-versed in XRP’s cross-border payments narrative, trust Ripple’s partnerships with banks, and even regard XRP as a “long-term asset for financial innovation.”

Whether XRP faces an SEC lawsuit or ongoing market pessimism, these users’ convictions remain largely unaffected.

The Stellar (XLM) community is much the same.

In many developing nations, Stellar’s collaborations with local financial service providers have built a genuine user base. These individuals may have no knowledge of staking or DeFi—or the broader blockchain ecosystem—but to them, Stellar is a recognized leading brand and valuable asset.

Cardano (ADA) has an even deeper cult following.

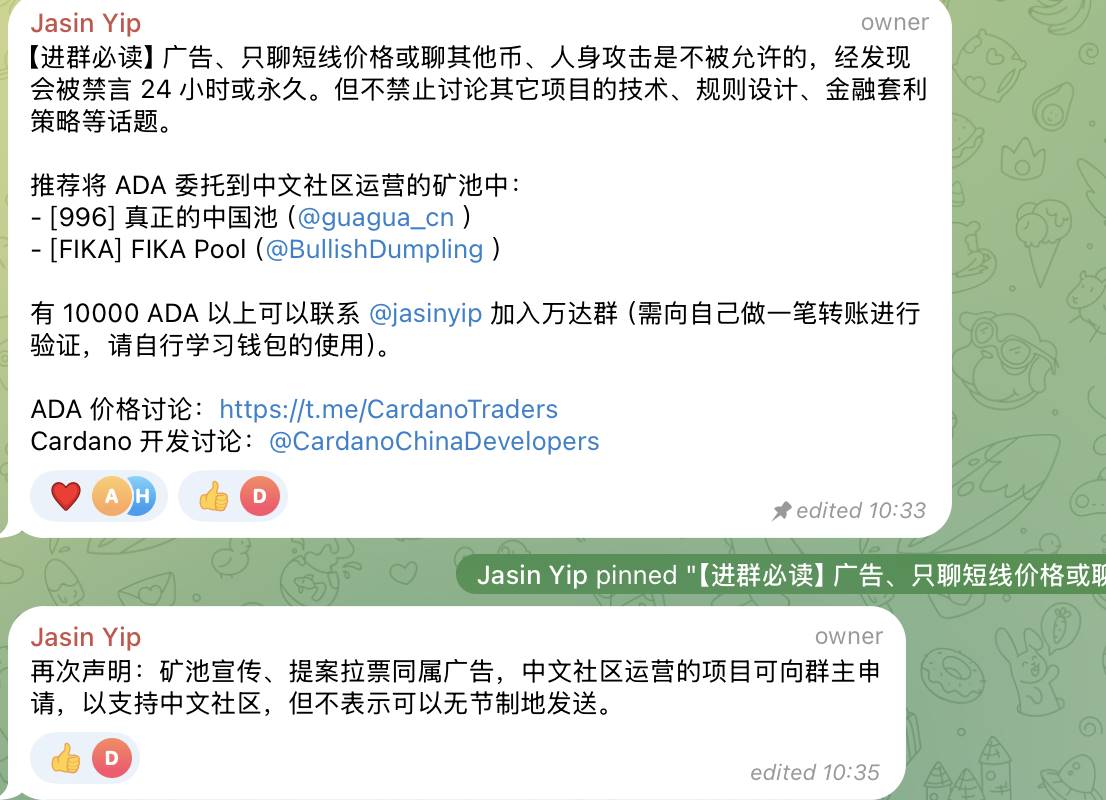

Across Japan, Africa, Eastern Europe, and parts of the English-speaking world, Cardano’s educational programs, governance initiatives, and community projects have cultivated a dedicated base of long-term holders. Even in China, there’s a prominent ADA community led by top-tier internet engineers.

These enthusiasts are consistently active on Reddit, Telegram, and local forums. They know Cardano’s technical roadmap and Founder Charles Hoskinson’s speeches inside out. Regardless of the ecosystem’s development speed or external criticism, their loyalty remains unwavering.

To outsiders, their convictions may seem disconnected from reality, but these beliefs form deeply rooted reasons to keep holding their tokens.

Together, these communities make up an ecosystem running in parallel to the mainstream crypto world.

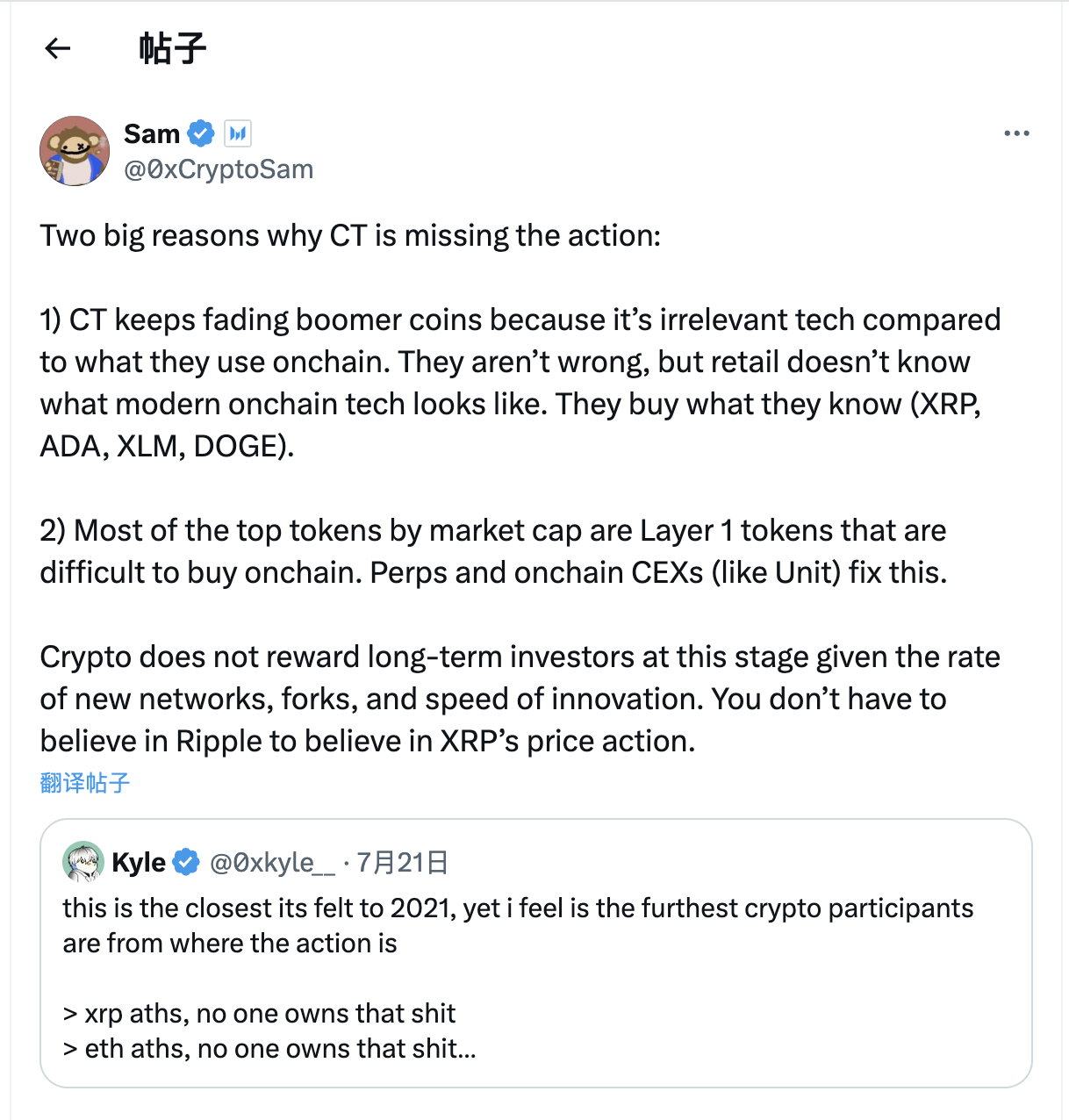

As Messari analyst Sam wrote on X, Crypto Twitter users often dismiss these “boomer coins” as obsolete compared to cutting-edge on-chain technologies. But while this view isn’t incorrect, the average retail investor doesn’t understand modern blockchain tech and simply buys what they know—XRP, ADA, XLM, DOGE.

Legacy coins don’t survive on hype or by following market narratives. Their communities more closely resemble user cultures from the Web2 era—brand loyalty, habits, emotional ties, and ingrained psychological patterns.

Their longevity isn’t rooted in the mainstream spotlight but rather hidden in those “overlooked corners” the broader crypto world rarely sees.

This is why exchanges are reluctant to delist tokens like XRP, XLM, or ADA.

Their trading volume, active user base, market depth, and role in hedging are core elements of any leading crypto exchange.

Even without technological breakthroughs, legacy tokens still hold significant positions in spot, margin, and perpetual trading rankings.

They’re part of the market’s foundation, favored by passive strategies and even considered familiar assets by speculators—whenever the market revives, liquidity finds its way back to them.

Beyond Capital—It’s Also About Politics

Beyond their users and communities, these projects wield economic and political influence well beyond what most expect.

The enduring presence of these so-called “outdated” projects isn’t just about loyal communities; they’ve established a secure position in the worlds of traditional finance and policy-making.

Take XRP: Ripple is more than just a technical or business organization. It’s a seasoned player, deeply engaged in global finance and policy development.

Ripple’s founders and senior executives are frequent speakers at international payment forums, U.S. Congressional hearings, and fintech summits—and they’ve maintained high-level connections in Washington.

In January 2025, Ripple CEO Brad Garlinghouse attended a Trump-hosted dinner at Mar-a-Lago in Florida, posting a photo with the caption “Strong start to 2025!”

On July 19, President Trump signed the Genius Act at the White House. Ripple’s Chief Legal Officer, Stuart Alderoty, was invited as one of the only crypto industry representatives present.

Throughout the SEC’s protracted lawsuit against Ripple, the company not only remained resilient—it achieved a favorable outcome, strengthening its political legitimacy in the conversation about compliant digital assets.

Additionally, for years Ripple has partnered with hundreds of global financial institutions, including Santander, PNC, Standard Chartered, SBI Holdings, and other major banks. This expansive business network is central to XRP’s continued credibility.

Cardano is driving blockchain education and digital ID projects in countries like Ethiopia and Rwanda, fully aligning with local government policies and governance agendas.

Hedera’s governing council features leading firms like Boeing, Google, IBM, and Deloitte. The governing council has contributed to U.S. dialogues on digital assets and distributed ledgers. Board member Brian Brooks is a former Acting Comptroller of the Currency and a close associate of current SEC Chair Paul Atkins.

These organizations operate well beyond the crypto industry—they actively shape regulatory, political, and business landscapes. They influence policy, negotiate regulatory outcomes, and tap their political and capital networks to maintain strategic positions.

For this reason, critics who focus purely on technology or storytelling often overlook the entrenched moats—built on capital and political power—that keep these legacy coins relevant.

Within this framework, these tokens aren’t lagging behind; they have pursued a strategy focused on durability and stability. Their true advantage comes from business scale, commercial alliances, and political protection.

So, the next time you spot XRP, XLM, ADA, or HBAR leading the charts, don’t be surprised, and avoid attributing it solely to technology or narrative.

They don’t need validation—they just need to endure.

Sometimes, just surviving long enough is an underrated competitive edge.

Disclaimer:

- This article is republished from TechFlow, and all copyright remains with the original author TechFlow. If you have concerns about this republication, please contact the Gate Learn team; we will handle the request promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article belong solely to the author and do not constitute investment advice of any kind.

- Other language versions of this article were translated by the Gate Learn team. Unless Gate is specifically mentioned, no translated article may be reproduced, distributed, or plagiarized without authorization.