- 话题

55135 热度

30352 热度

49764 热度

51414 热度

17847 热度

20771 热度

6659 热度

3957 热度

115787 热度

- 10我的Gate时刻

28241 热度

- 置顶

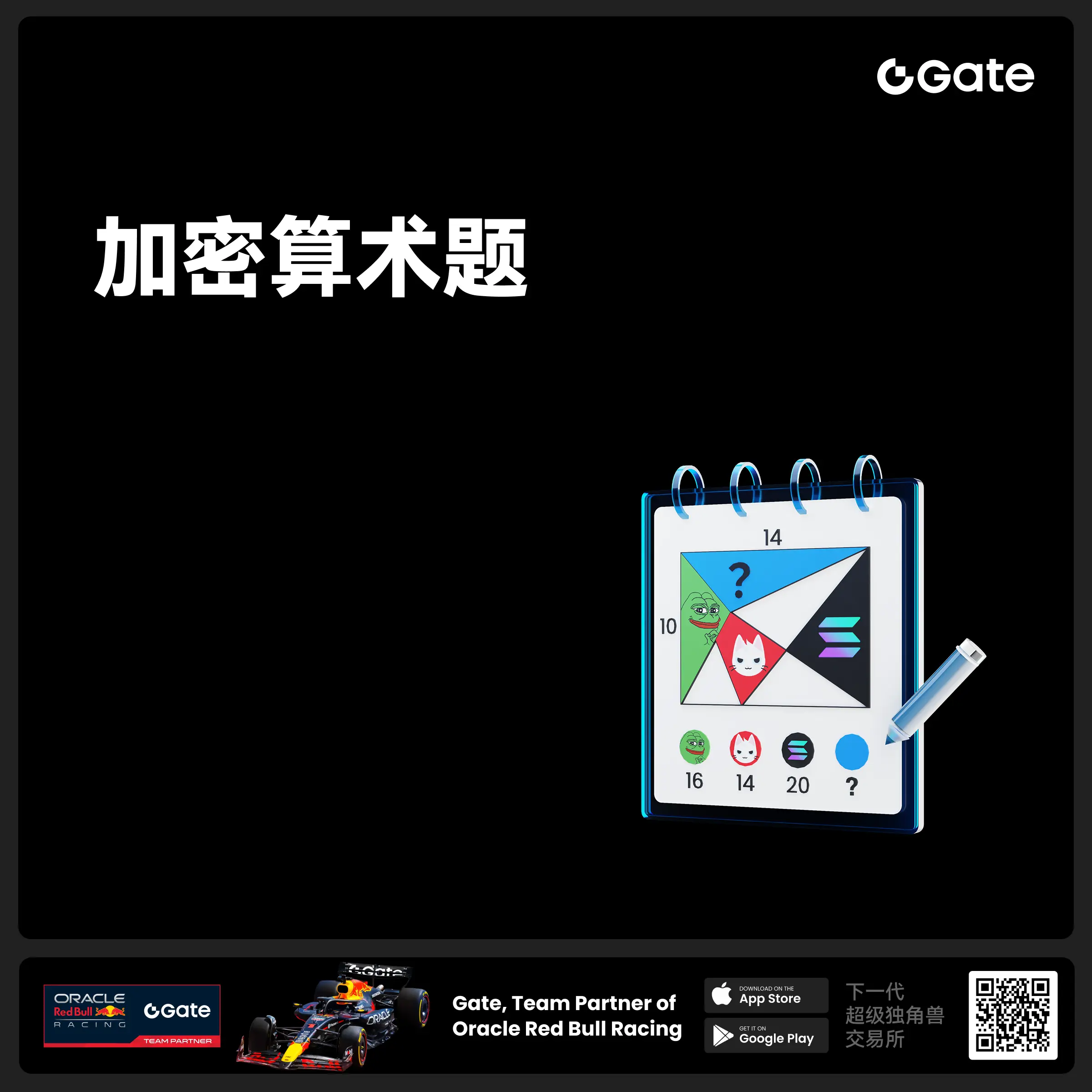

- 🧠 #GateGiveaway# - 加密算术题挑战!

你能解出这道加密题吗?

💰 $10 合约体验券 * 4 位获奖者

参与方式:

1️⃣ 关注 Gate广场_Official

2️⃣ 点赞此条动态贴文

3️⃣ 在评论中留下你的答案

📅 截止时间:7 月 22 日 12:00(UTC+8)

- 📢 ETH冲击4800?我有话说!快来“Gate广场”秀操作,0.1 ETH大奖等你拿!

牛市预言家,可能下一个就是你!想让你的观点成为广场热搜、赢下ETH大奖?现在就是机会!

💰️ 广场5位优质发帖用户+X浏览量前5发帖用户,瓜分0.1 ETH!

🎮 活动怎么玩,0门槛瓜分ETH!

1.话题不服来辩!

带 #ETH冲击4800# 和 #ETH# 在 广场 或 K线ETH下 围绕一下主题展开讨论:

-ETH是否有望突破4800?

-你看好ETH的原因是什么?

-你的ETH持仓策略是?

-ETH能否引领下一轮牛市?

2. X平台同步嗨

在X平台发帖讨论,记得带 #GateSquare# 和 #ETH冲击4800# 标签!

把你X返链接提交以下表单以瓜分大奖:https://www.gate.com/questionnaire/6896

✨发帖要求:

-内容须原创,字数不少于100字,且带活动指定标签

-配图、行情截图、分析看法加分,图文并茂更易精选

-禁止AI写手和灌水刷屏,一旦发现取消奖励资格

-观点鲜明、逻辑清晰,越有料越好!

关注ETH风向,创造观点价值,从广场发帖开始!下一个牛市“预言家”,可能就是你!🦾🏆

⏰ 活动时间:2025年7月18日 16:00 - 2025年7月28日 23:59(UTC+8)

【立即发帖】 展现你的真知灼见,赢取属于你的ETH大奖!

- 🎉 #Gate Alpha 第三届积分狂欢节 & ES Launchpool# 联合推广任务上线!

本次活动总奖池:1,250 枚 ES

任务目标:推广 Eclipse($ES)Launchpool 和 Alpha 第11期 $ES 专场

📄 详情参考:

Launchpool 公告:https://www.gate.com/zh/announcements/article/46134

Alpha 第11期公告:https://www.gate.com/zh/announcements/article/46137

🧩【任务内容】

请围绕 Launchpool 和 Alpha 第11期 活动进行内容创作,并晒出参与截图。

📸【参与方式】

1️⃣ 带上Tag #Gate Alpha 第三届积分狂欢节 & ES Launchpool# 发帖

2️⃣ 晒出以下任一截图:

Launchpool 质押截图(BTC / ETH / ES)

Alpha 交易页面截图(交易 ES)

3️⃣ 发布图文内容,可参考以下方向(≥60字):

简介 ES/Eclipse 项目亮点、代币机制等基本信息

分享你对 ES 项目的观点、前景判断、挖矿体验等

分析 Launchpool 挖矿 或 Alpha 积分玩法的策略和收益对比

🎁【奖励说明】

评选内容质量最优的 10 位 Launchpool/Gate - 和其他领域不一样的是:你想支持一个 Web3 游戏项目,你必须要「双投」——既要投时间,也要投钱。

- 🎉【Gate 3000万纪念】晒出我的Gate时刻,解锁限量好礼!

Gate用户突破3000万!这不仅是数字,更是我们共同的故事。

还记得第一次开通账号的激动,抢购成功的喜悦,或陪伴你的Gate周边吗?

📸 参与 #我的Gate时刻# ,在Gate广场晒出你的故事,一起见证下一个3000万!

✅ 参与方式:

1️⃣ 带话题 #我的Gate时刻# ,发布包含Gate元素的照片或视频

2️⃣ 搭配你的Gate故事、祝福或感言更佳

3️⃣ 分享至Twitter(X)可参与浏览量前10额外奖励

推特回链请填表单:https://www.gate.com/questionnaire/6872

🎁 独家奖励:

🏆 创意大奖(3名):Gate × F1红牛联名赛车模型一辆

👕 共创纪念奖(10名): 国际米兰同款球员卫衣

🥇 参与奖(50名):Gate 品牌抱枕

📣 分享奖(10名):Twitter前10浏览量,送Gate × 国米小夜灯!

*海外用户红牛联名赛车折合为 $200 合约体验券,国米同款球衣折合为 $50 合约体验券,国米小夜灯折合为 $30 合约体验券,品牌抱枕折合为 $20 合约体验券发放

🧠 创意提示:不限元素内容风格,晒图带有如Gate logo、Gate色彩、周边产品、GT图案、活动纪念品、活动现场图等均可参与!

活动截止于7月25日 24:00 UTC+8

3

Bitcoin at $103K hurtles MARA stack toward $5B, holdings triple

Bitcoin mining firm MARA Holdings (MARA) nearly tripled its Bitcoin holdings over 12 months, according to its newly released Q1 results.

However, its Bitcoin production fell, and total earnings slightly missed Wall Street estimates in Q1.

MARA, formerly Marathon Digital, saw its Bitcoin (BTC) holdings increase to 47,531 BTC, up 175% from the 17,320 BTC the firm was holding at the end of Q1 2024.

MARA holdings inch closer to $5B after Bitcoin pump

MARA holds the second-largest amount of Bitcoin among all publicly traded companies, according to CoinGecko data. Strategy (MSTR) holds the number one spot with 555,450 Bitcoin.

The holdings represent a total value of approximately $4.9 billion, based on Bitcoin’s current price of $102,660 at the time of publication, according to CoinMarketCap data. Over the past 24 hours, Bitcoin’s price spiked 4.86%.

MARA attributed this to the last Bitcoin halving event, which reduced mining rewards to 3.125 BTC per block and tightened overall supply.

MARA fell short of analyst revenue expectations by 0.35%, according to Zacks Research. The analysts pointed out that MARA has only surpassed consensus revenue estimates once in the past four quarters.

Bitcoin mining firms share same frustrations

Bitcoin miner Riot Platforms echoed similar difficulties in their recent Q1 financial report

Riot said that the average cost to mine Bitcoin over the quarter was $43,808, almost 90% more than the $23,034 it cost to mine Bitcoin in the same period last year. However, Riot beat its $159.8 million revenue consensus estimate by 1%.

Related: Bitcoin miner Hive taps Paraguay for low-cost energy partnership

Several other Bitcoin mining firms also fell short of Wall Street’s revenue expectations.

Bitcoin miner CleanSpark missed consensus estimates by 0.58%, reporting quarterly revenue of $181.71 million.

Bitcoin miner Core Scientific also fell short of analyst expectations with total Q1 revenue reaching $79.5 million, missing Zacks analysts’ estimates by 8.11% and falling from its $179.3 million revenue for Q1 2024

Meanwhile, Bitcoin miner Hut8 reported the widest miss among Bitcoin mining firms, falling 35% short of Wall Street expectations.

Zacks Research had projected Hut8 to post first-quarter revenue of $35 million, but Hut8 came in significantly lower at just $21 million.

Magazine: ChatGPT a ‘schizophrenia-seeking missile,’ AI scientists prep for 50% deaths: AI Eye

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.