- 话题

5k 热度

2k 热度

7k 热度

5k 热度

2k 热度

15k 热度

31k 热度

18k 热度

29k 热度

143k 热度

- 置顶

- 🎉Gate 2025 上半年社区盛典:内容达人评选投票火热进行中 🎉

🏆 谁将成为前十位 #Gate广场# 内容达人?

投票现已开启,选出你的心头好

🎁赢取 iPhone 16 Pro Max、限量周边等好礼!

📅投票截止:8 月 15 日 10:00(UTC+8)

立即投票: https://www.gate.com/activities/community-vote

活动详情: https://www.gate.com/announcements/article/45974

- 📢 #Gate广场征文活动第二期# 正式启动!

分享你对 $ERA 项目的独特观点,推广ERA上线活动, 700 $ERA 等你来赢!

💰 奖励:

一等奖(1名): 100枚 $ERA

二等奖(5名): 每人 60 枚 $ERA

三等奖(10名): 每人 30 枚 $ERA

👉 参与方式:

1.在 Gate广场发布你对 ERA 项目的独到见解贴文

2.在贴文中添加标签: #Gate广场征文活动第二期# ,贴文字数不低于300字

3.将你的文章或观点同步到X,加上标签:Gate Square 和 ERA

4.征文内容涵盖但不限于以下创作方向:

ERA 项目亮点:作为区块链基础设施公司,ERA 拥有哪些核心优势?

ERA 代币经济模型:如何保障代币的长期价值及生态可持续发展?

参与并推广 Gate x Caldera (ERA) 生态周活动。点击查看活动详情:https://www.gate.com/announcements/article/46169。

欢迎围绕上述主题,或从其他独特视角提出您的见解与建议。

⚠️ 活动要求:

原创内容,至少 300 字, 重复或抄袭内容将被淘汰。

不得使用 #Gate广场征文活动第二期# 和 #ERA# 以外的任何标签。

每篇文章必须获得 至少3个互动,否则无法获得奖励

鼓励图文并茂、深度分析,观点独到。

⏰ 活动时间:2025年7月20日 17

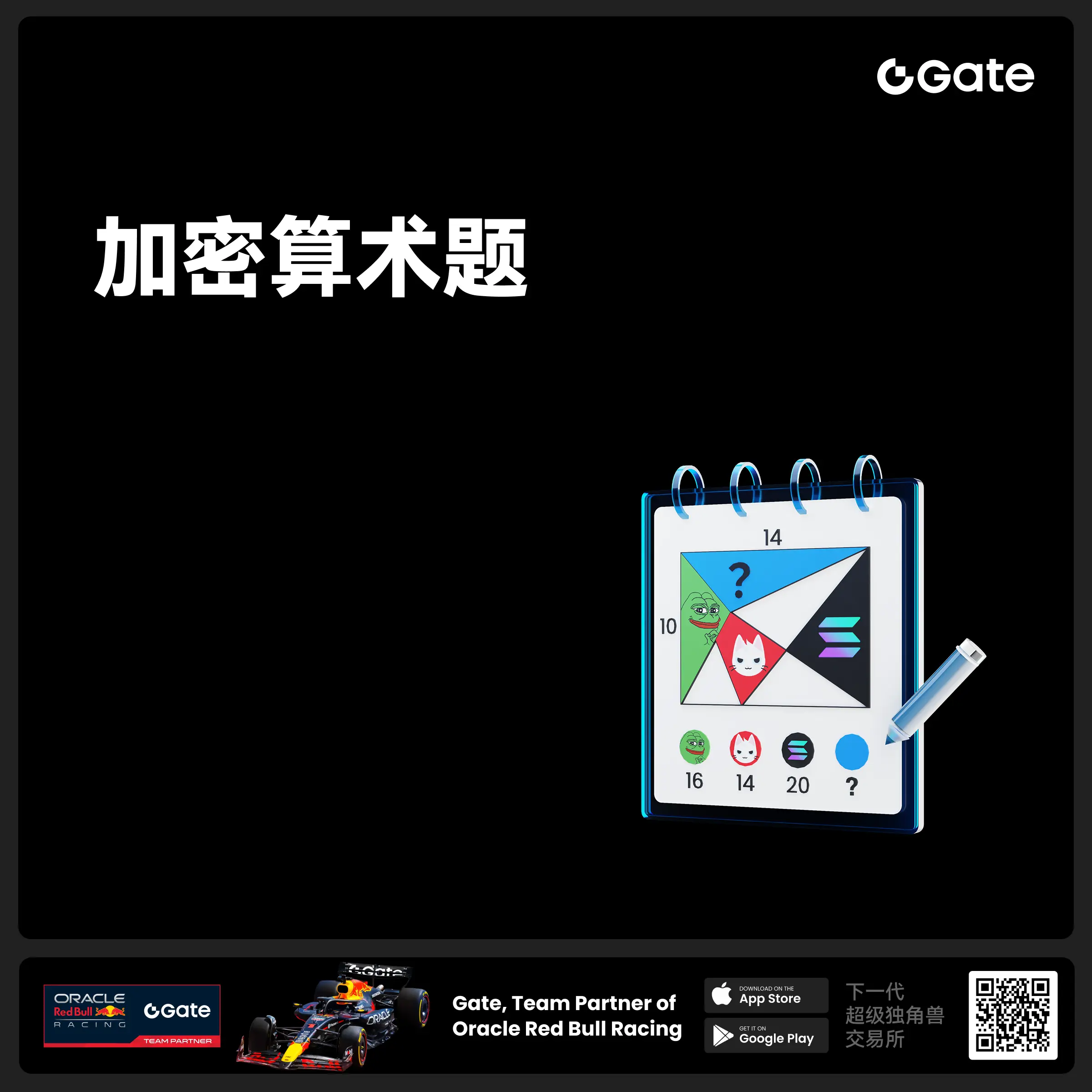

- 🧠 #GateGiveaway# - 加密算术题挑战!

你能解出这道加密题吗?

💰 $10 合约体验券 * 4 位获奖者

参与方式:

1️⃣ 关注 Gate广场_Official

2️⃣ 点赞此条动态贴文

3️⃣ 在评论中留下你的答案

📅 截止时间:7 月 22 日 12:00(UTC+8)

- 📢 ETH冲击4800?我有话说!快来“Gate广场”秀操作,0.1 ETH大奖等你拿!

牛市预言家,可能下一个就是你!想让你的观点成为广场热搜、赢下ETH大奖?现在就是机会!

💰️ 广场5位优质发帖用户+X浏览量前5发帖用户,瓜分0.1 ETH!

🎮 活动怎么玩,0门槛瓜分ETH!

1.话题不服来辩!

带 #ETH冲击4800# 和 #ETH# 在 广场 或 K线ETH下 围绕一下主题展开讨论:

-ETH是否有望突破4800?

-你看好ETH的原因是什么?

-你的ETH持仓策略是?

-ETH能否引领下一轮牛市?

2. X平台同步嗨

在X平台发帖讨论,记得带 #GateSquare# 和 #ETH冲击4800# 标签!

把你X返链接提交以下表单以瓜分大奖:https://www.gate.com/questionnaire/6896

✨发帖要求:

-内容须原创,字数不少于100字,且带活动指定标签

-配图、行情截图、分析看法加分,图文并茂更易精选

-禁止AI写手和灌水刷屏,一旦发现取消奖励资格

-观点鲜明、逻辑清晰,越有料越好!

关注ETH风向,创造观点价值,从广场发帖开始!下一个牛市“预言家”,可能就是你!🦾🏆

⏰ 活动时间:2025年7月18日 16:00 - 2025年7月28日 23:59(UTC+8)

【立即发帖】 展现你的真知灼见,赢取属于你的ETH大奖!

- 🎉 #Gate Alpha 第三届积分狂欢节 & ES Launchpool# 联合推广任务上线!

本次活动总奖池:1,250 枚 ES

任务目标:推广 Eclipse($ES)Launchpool 和 Alpha 第11期 $ES 专场

📄 详情参考:

Launchpool 公告:https://www.gate.com/zh/announcements/article/46134

Alpha 第11期公告:https://www.gate.com/zh/announcements/article/46137

🧩【任务内容】

请围绕 Launchpool 和 Alpha 第11期 活动进行内容创作,并晒出参与截图。

📸【参与方式】

1️⃣ 带上Tag #Gate Alpha 第三届积分狂欢节 & ES Launchpool# 发帖

2️⃣ 晒出以下任一截图:

Launchpool 质押截图(BTC / ETH / ES)

Alpha 交易页面截图(交易 ES)

3️⃣ 发布图文内容,可参考以下方向(≥60字):

简介 ES/Eclipse 项目亮点、代币机制等基本信息

分享你对 ES 项目的观点、前景判断、挖矿体验等

分析 Launchpool 挖矿 或 Alpha 积分玩法的策略和收益对比

🎁【奖励说明】

评选内容质量最优的 10 位 Launchpool/Gate

Macro drivers will dampen Bitcoin’s halving cycle — Tim Draper

Macroeconomic drivers, including the decline of the US dollar (USD), will dampen the effects of the Bitcoin (BTC) halving cycle, which is the source of the market booms and busts that have been a feature of BTC since 2009, according to investor and founding partner of venture capital (VC) firm Draper Associates, Tim Draper.

“Between 10-20 years from now, the dollar will be extinct,” Draper told Cointelegraph in an interview “The world is changing, and we are watching it happen. We are right in the center of an anthropological leap forward,” he added.

I think there will be a macro driver that pushes Bitcoin along, and I think the macro driver will be a bigger deal than the halvings,” the VC continued.

The potential disruption of the four-year market cycle continues to be debated, with some, like the CEO of Xapo Bank, Seamus Rocca, arguing that the four-year cycle isn’t dead yet, and others saying that BTC has matured into a macroeconomic asset that has shed its traditional market dynamics.

Related: Bitcoin smack dab in the middle of its adoption curve: Fidelity analyst

Bitcoin and hard money alternatives are positioned to benefit from USD decline

In February, Bitwise analyst Jeff Park predicted that Bitcoin would appreciate in value and gain widespread global adoption due to growing geopolitical tensions, currency inflation, the decline of the US dollar, and the resurgence of protectionist trade policies.

The Trump administration has repeatedly said that dollar-denominated stablecoins are central to maintaining the dollar’s global reserve status. By placing the dollar on blockchain rails, it allows anyone with a cellphone and a crypto wallet to add demand for US dollars.

However, Bitcoin maximalist Max Keiser argues that US dollar stablecoins are a temporary solution to the declining dollar and will be outcompeted by gold-backed tokens and BTC.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears